Pepenode ($PEPENODE) Nears $500k In Presale – Is This The Next Big Meme Utility Token?

For far too long, the meme coin market has been flooded with a countless number of presales that offer neither engagement, utility, nor innovation.

Even after launch, most of these projects still relegate early participants to passive investors, and as a result, they often fade into obscurity quickly.

Pepenode, however, stands apart from the crowd, thanks to its robust staying power, genuine virtual mining utility, and rapidly growing community base.

Unlike typical fleeting meme coin presales where investors buy tokens and then wait for weeks or months before anything happens, Pepenode delivers immediate engagement and utility right from day one.

At its core is a virtual mine-to-earn system where users can start building, earning, and competing the moment they join the presale, all without physical hardware.

Basically, this ecosystem seamlessly combines virtual mining with gamified rewards, allowing participants to set up miner nodes, upgrade facilities, and climb through a leaderboard specially built to incentivize consistent engagement.

Combined with the allure of earning real meme coins like Pepe and Fartcoin, Pepenode is clearly establishing a strong and unique value proposition even before it arrives on exchanges.

It is therefore not without reason that its presale has been witnessing heavy demand since its debut, raising approximately $500k at press time.

And with the price currently available for as low as $0.001032, more smart money investors are beginning to pay attention, signaling that it could sell out of schedule.

Introducing Pepenode

Crypto mining has been a hassle. Small miners are struggling to stay profitable, tech nerds keep dominating the space, and the barriers to entry are even higher than ever.

Changing the whole game is Pepenode, a fully decentralized project that combines virtual mining with meme coin rewards in ways that haven’t been seen before in the crypto space.

At the heart of this project lies a mine-to-earn architecture, which ultimately transforms the idea of mining into a fully virtual, gamified experience. Therefore, instead of purchasing expensive physical hardware like GPUs, users step into a virtual mining world by just buying $PEPENODE tokens during the ongoing presale.

Then, they can build, explore, and watch their rewards grow through their mining activities, making the entire experience feel more like a game than a token sale. Not only does this innovative approach add practical use cases to $PEPENODE, but it also gives early participants something tangible to do with their tokens right from launch.

Let’s unpack this even further: the mining game begins the moment you join the presale. You will be granted access to a virtual dashboard where you can purchase Miner Nodes, upgrade facilities to increase your mining strength, and earn rewards through strategic gameplay.

It’s like a resource-building adventure in the virtual world, rooted in the real sense of progress and ownership, creating a completely different investment experience compared to traditional meme coins.

Beyond $PEPENODE, there is even the fun of earning top meme coins through virtual mining activities, adding an extra layer of cross-token appeal that other meme coins don’t offer.

And as the mining rig grows stronger, so do the rewards. Thankfully, users can check each action and upgrade in real time on the dashboard, a feat that speaks to its utmost commitment to transparency. There’s no need to worry about the technical requirements of the game: the simulator does all of that in a simple, straightforward format.

At the same time, everything runs through a browser, both on mobile or desktop devices, with no gas fees or network congestion, thanks to its off-chain operation. Right after the token launch, all operations move on-chain, making the mining experience more transparent and permanent.

This strategic approach could lay the groundwork for Pepenode’s success, both in the short and long term, helping it build and retain stronger communities that feel directly connected to its future.

Meanwhile, beyond its functional mine-to-earn use cases, here are a few other standout features that have made Pepenode an appealing investment for all kinds of investors seeking long-term value:

Impressive Staking Yields

Staking is nothing new in crypto presales, but the fact that Pepenode is connecting it directly to the virtual mining system, makes things even more interesting.

As per the project whitepaper, users can boost their mining efficiency and rewards by staking their tokens. The APY is very competitive, currently above 3500%, and with demand rising, early investors will be able to easily capitalize on strong staking rewards before the supply tightens.

More so, the team has indicated that stakers will receive extra benefits like bonuses and leaderboard perks when the project launches its full on-chain version, further making early participation more valuable.

To top it off, there is a referral system that rewards community growth, letting users monetize their influence.

Deflationary Mechanics

Whenever a user upgrades a node using $PEPENODE, 70% of the tokens are permanently removed from circulation. This deflationary mechanism is generally known to have a positive effect on prices.

And as the demand for $PEPENODE increases, perhaps due to the growing adoption of its mine-to-earn ecosystem and exchange listings, consistent burning could be a tailwind for the token to take off.

As such, it won’t be surprising to see the meme coin experience a major spike in price as soon as it hits exchanges, delivering substantial listing returns to early investors.

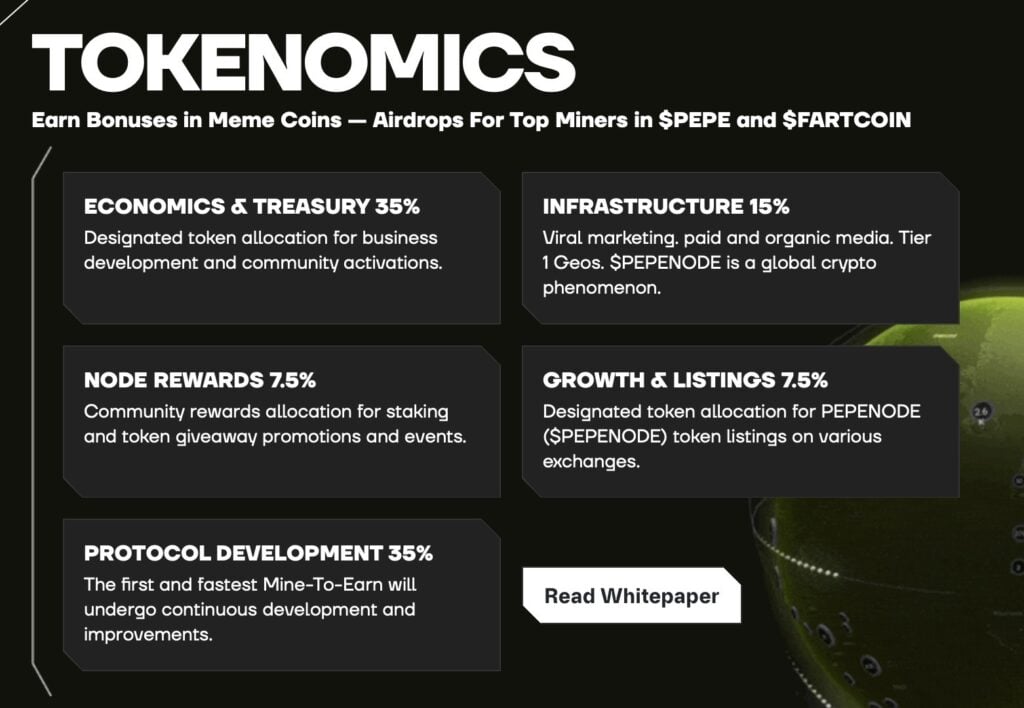

In terms of tokenomics, the project team has reserved substantial allocations for protocol development and upgrades, node rewards, exchange liquidity, and marketing.

Sustainable Roadmap

Early investors must have taken notice of Pepenode’s structured four-phase roadmap, which underscores a long-term vision for growth and sustainability. Phase one is now live, featuring the presale and the launch of an off-chain mining game for early engagement.

Phase two will focus on the Token Generation Event (TGE), activation of staking rewards and node utility, as well as listings on major exchanges.

Things get more exciting in Phase three with transition from off-chain to fully on-chain mining alongside other key features like NFT-based upgrades and leaderboards. The fourth phase, which is the final stage of the roadmap, is dedicated to expansion, rolling out key features like mobile apps and multi-token rewards.

Is Pepenode the Next Meme Coin to Watch Closely?

$PEPENODE’s presale has already gained significant attention from every corner of the meme coin industry, raising close to $500k within a short timeframe and attracting a growing community of supporters.

This is no surprise, considering the strategic way in which it delivers instantaneous mine-to-earn use cases, distinguishing it from traditional meme coins that just sit idle in investors’ wallets.

More so, the project’s roadmap highlights ambitious but realistic goals, including transition to on-chain mining, mobile app launch, multi-token rewards, CEX listings, staking functionality, and many more. With all these plans in motion, Pepenode is well-poised to expand its reach and utility

The token’s deflationary model further boosts its potential, striking the right balance between demand and supply. And given the growing traction in both retail and whale circles, it is reasonable to expect sustained interest even after the presale concludes.

Moreover, cryptos that see huge investments during presale often go on to deliver outsized returns, and Pepenode is poised to follow the same path.

Should this level of exposure continue post-presale, there is a strong potential for $PEPENODE to experience anywhere between 10x and 50x surge before the end of 2025.

To learn more about the project, check out the official Pepenode social media channels on Twitter and Telegram.

Visit Pepenode

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse