Comparative Analysis: What are the differences between MEME launch platform Clanker and Pump.fun?

Author: Poopman , Cryptography Researcher

Compiled by: Felix, PANews

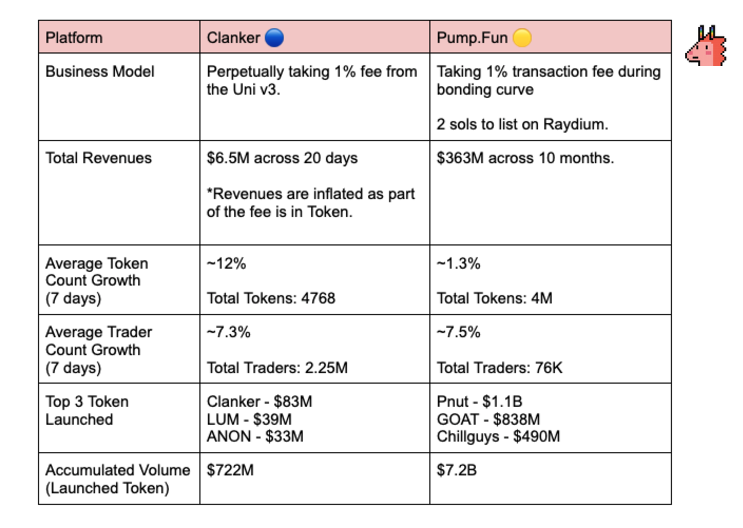

Recently, many well-known meme coins have emerged on the Base ecosystem meme coin issuance platform Clanker, including CLANKER, ANON, etc. Crypto researcher Poopman published an article comparing Clanker and Pump.fun in multiple dimensions such as business models. The following is the content details.

1 ) Business Model

PumpFun: A 1% transaction fee + 2 SOLs are charged during the Bonding Curves (a process that uses smart contracts and mathematical formulas to dynamically adjust the price of tokens based on the supply of tokens) to be listed on Raydium.

Clanker: Since there is no bonding curve, use the #LpFeesCut function and collect 1% fees from Uni v3 forever.

New upgrade: 0.4% of fees are returned to issuers, providing more incentives for issuing tokens.

2 ) Total income

PumpFun: $363 million in 10 months. Currently 55 times that of Clanker.

Clanker: $6-7 million in revenue in 20 days. Revenue is inflated because part of the fees are in tokens.

3 ) Token quantity growth ( 7 days)

PumpFun: 4 million tokens, daily growth of about 1.3%

Clanker: 4768 tokens to date, with a daily growth of about 12%

4 ) Top 3 tokens issued

PumpFun:

- Pnut: $1.1 billion

- GOAT: $838 million

- Chillguys: $490 million

Clanker:

- Clanker: $83 million

- LUM: $39 million

- ANON: $33 million

Some key points:

Although Clanker has successfully channeled a large amount of Base volume, it has yet to show any signals in Farcaster’s favor.

Early robot sniping seemed to be a problem, but there was no clear/accurate data on its toxicity.

Farcaster’s limited user base may hinder the growth of the token number. However, this design can provide strategic value to Base and Farcaster.

The continuous increase in the types of assets on Base is the key to unlocking the "real" Base Season.

Related reading: Clanker recasts the glory of Ethereum ecosystem Meme? Analysis of AI Agent coin issuance application on Base chain

You May Also Like

Shibarium May No Longer Turbocharge Shiba Inu Price Rally, Here’s Reason

👨🏿🚀TechCabal Daily – When banks go cashless