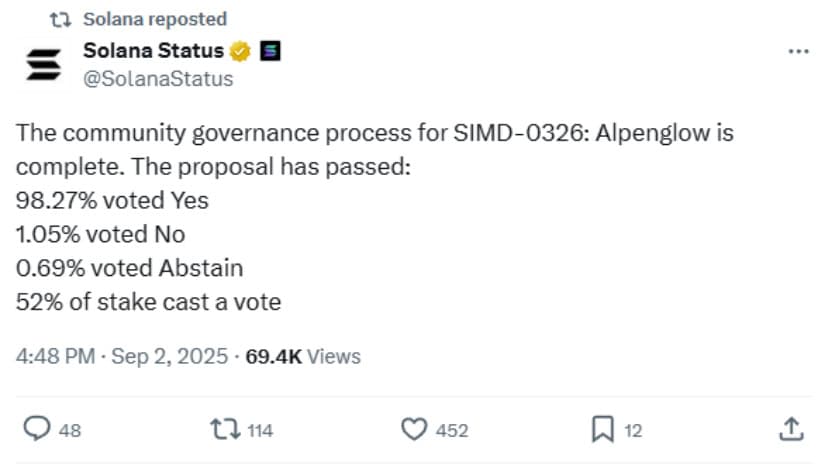

Solana’s Alpenglow Upgrade Passes with 98% Approval, Promising 100x Speed Boost

The governance vote concluded on September 2, 2025, with 52% of the network’s total stake participating. Only 1.05% voted against the upgrade, while 0.69% abstained. This strong support clears the way for Solana to implement changes that could make it the fastest major blockchain network.

What Makes Alpenglow Revolutionary

The Alpenglow upgrade will cut transaction finality times from over 12 seconds to just 100-150 milliseconds. This represents a 100x improvement in speed, bringing Solana’s performance closer to traditional payment systems like Visa.

The upgrade replaces two core systems that currently run Solana. Proof-of-History, which timestamps transactions, will be replaced by a new system called Rotor. TowerBFT, which handles validator voting, will be replaced by Votor.

Votor uses off-chain voting to speed up the consensus process. When 80% of validators participate, blocks can finalize in just one round. If only 60% participate, the system still works but takes two rounds to complete.

Rotor improves how data moves between validators. It cuts the number of network hops needed and reduces bandwidth usage by 40%. This helps the entire network run more efficiently.

Strong Network Security Features

The upgrade includes a “20+20” resilience model that keeps the network running even during major problems. The system can continue operating if 20% of validators act maliciously and another 20% go offline simultaneously.

This fault tolerance addresses concerns that institutions often have about blockchain reliability. Traditional financial systems need to maintain uptime, and Alpenglow helps Solana meet these standards.

Source: @SolanaStatus

The upgrade also dramatically reduces costs for validators. Running a validator node will cost about $1,000 per year instead of the current $60,000. This change makes it easier for more people to participate in securing the network, which improves decentralization.

Validators will also save roughly $5,000 monthly in on-chain voting fees since the new system moves voting off-chain.

Growing Institutional Interest

Major institutions are showing increased interest in Solana’s capabilities. The network has seen growing corporate adoption, with companies like BlackRock, Stripe, and SpaceX forming partnerships with projects in the Solana ecosystem.

Solana’s DeFi ecosystem continues growing rapidly. Total Value Locked reached $8.6 billion in Q2 2025, representing a 30.4% increase from the previous quarter. The network’s App Revenue Capture Ratio hit 211.6%, showing strong economic activity.

The REX-Osprey Solana ETF has gained traction with investors seeking regulated exposure to Solana. Recent trading sessions have shown strong institutional interest in Solana-based investment products.

Hedge funds and trading firms are positioning for the upgrade’s benefits. The combination of faster transactions and lower costs makes Solana attractive for high-frequency trading applications.

Technical Performance Advantages

The speed improvements put Solana ahead of major competitors. Ethereum takes about 15 minutes to reach finality after the Merge upgrade. Sui, another fast blockchain, achieves 400-millisecond finality. Alpenglow’s 150-millisecond target would make Solana faster than both.

The upgrade enables new use cases that require near-instant confirmation. High-frequency trading, real-time gaming, and instant payments become more practical when transactions finalize in milliseconds rather than seconds.

The development firm Anza, which created Alpenglow, designed the system to handle over 107,000 transactions per second. This throughput exceeds most traditional payment networks while maintaining blockchain security benefits.

The environmental impact remains low despite the performance gains. Solana already uses less energy than proof-of-work blockchains, and Alpenglow maintains this efficiency while adding speed.

Market Response and Price Impact

SOL price has remained stable above $200 despite broader market volatility. The Alpenglow approval has contributed to positive sentiment among traders and investors.

Technical analysts see potential for SOL to reach $250-300 if the upgrade delivers on its promises. Some long-term projections suggest the token could reach higher levels as adoption increases.

Staking yields of 7.16% attract institutional investors compared to Ethereum’s 3.01% yield. About 64.8% of SOL’s circulating supply is now staked, with liquid staking rates rising to 12.2%.

The combination of technical improvements and growing institutional adoption creates positive momentum for the network’s future value.

The Path Ahead

While no official timeline exists for mainnet deployment, the upgrade is expected to launch by late 2025 or early 2026. The strong governance support removes a major hurdle for implementation.

Solana’s broader roadmap includes additional features like Application-Controlled Execution and Multiple Concurrent Leaders. These future upgrades would further enhance the network’s capabilities for financial applications.

Developers are already preparing applications that take advantage of the faster finality times. Gaming platforms, DeFi protocols, and payment systems all benefit from sub-second transaction confirmation.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

TRM Labs Becomes Unicorn with 70M$: BTC Fraud Risk