Pump.fun’s new model revives the Solana-based meme coins culture

- Pump.fun’s new creator fee model boosts revenue, surpassing Hyperliquid over the last 24 hours.

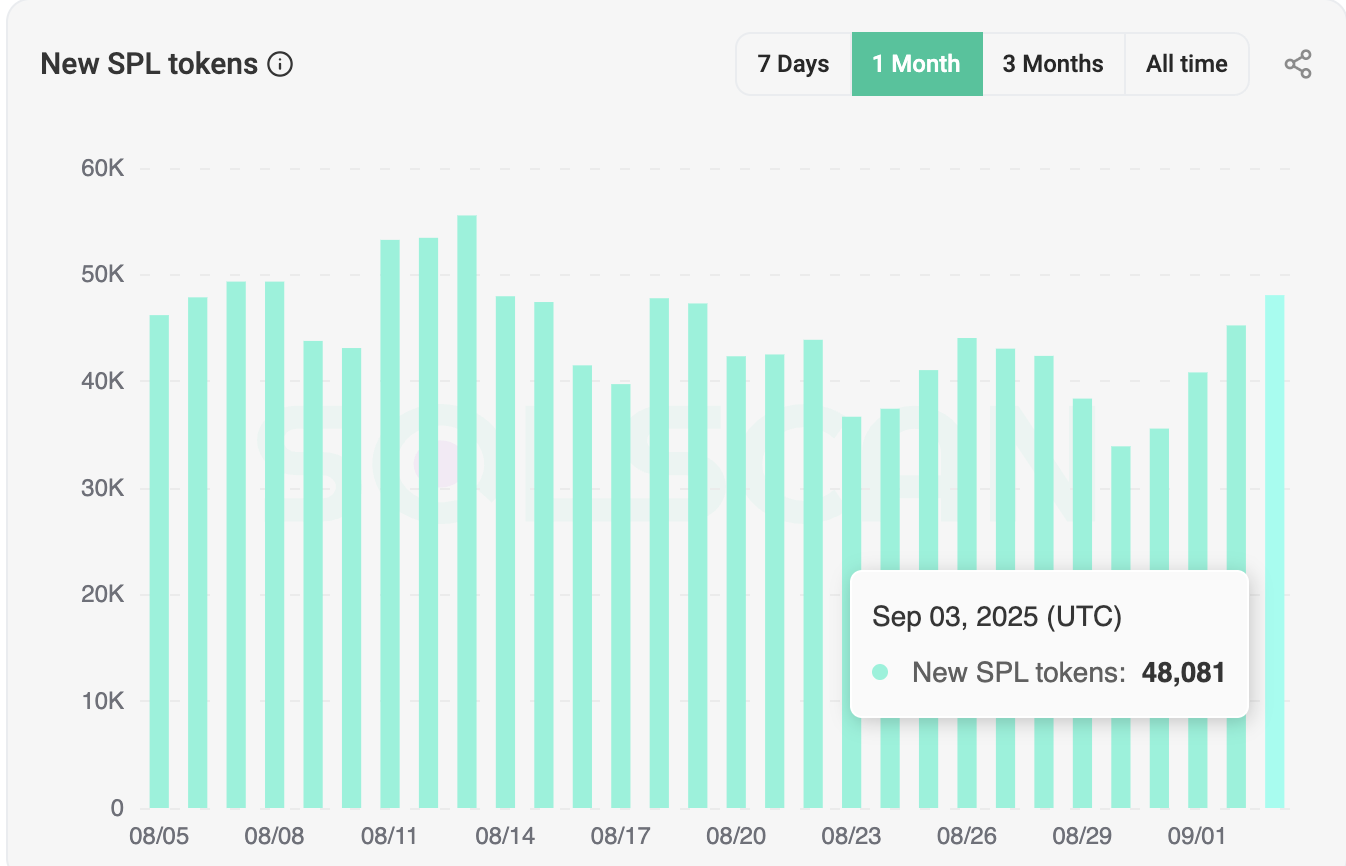

- SPL tokens created on Wednesday hit the highest level since mid-August, indicating an increase in meme coins on the network.

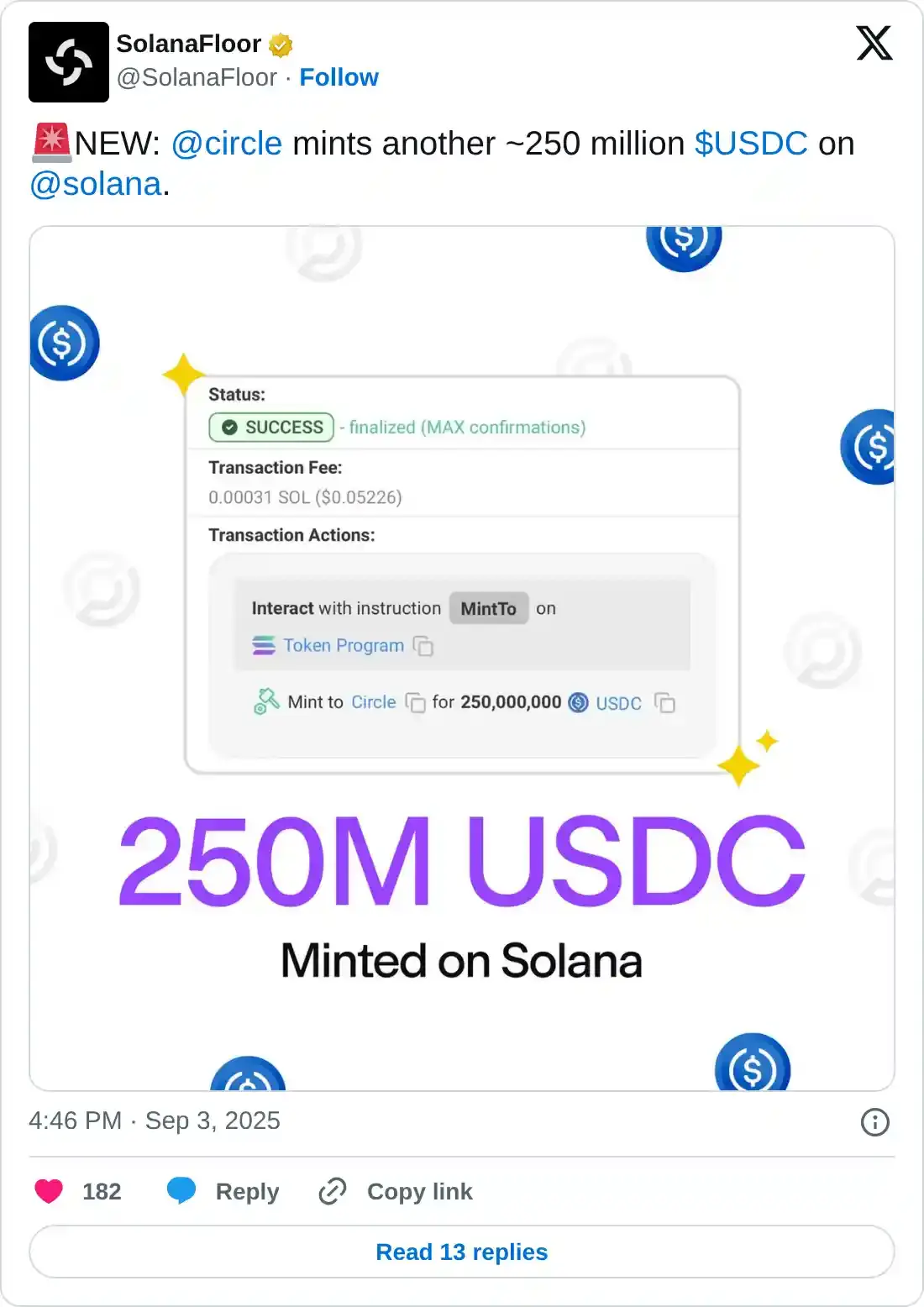

- Circle mints another 250 million USDC on Solana, boosting the network’s liquidity.

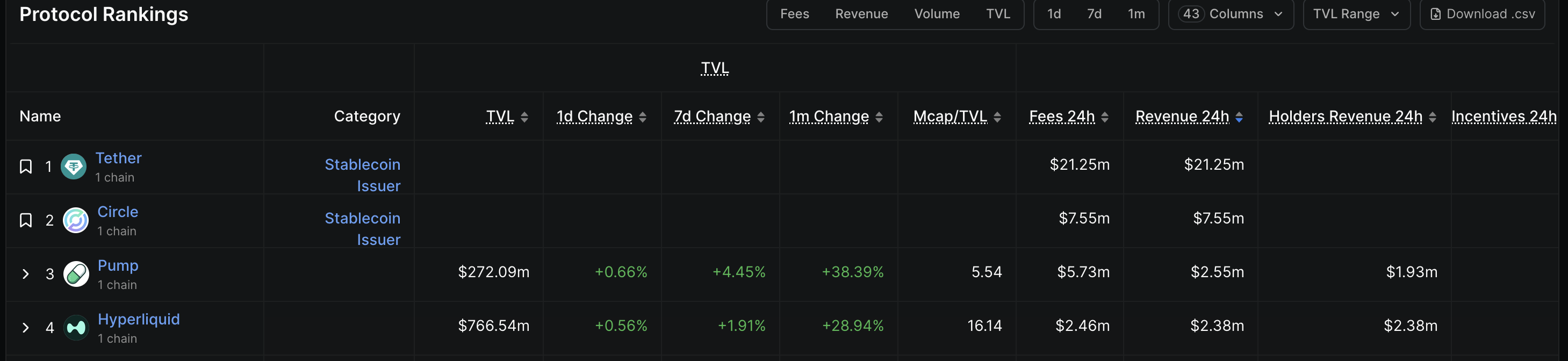

Meme coins based on the Solana ecosystem are warming up, with Pump.fun (PUMP) becoming the top revenue-generating protocol in the crypto market, now only behind stablecoin issuers like Tether and Circle, underpinned by its new creator fee model. The new Solana Program Library (SPL) tokens created on Solana (SOL), alongside the liquidity boost provided by Circle’s USDC stablecoin, could add fuel to the resurging demand for Solana-based meme coins.

Pump.fun rewires demand for Solana-based meme coins

Pump.fun, the Solana-based meme coin launchpad, launched its new dynamic fee model to boost the creator economy. The model reduces the creator fee on the platform to 0.05% from the previous 0.95% high, provided the project achieves a market cap of 98,240 SOL.

With the new dynamic model, creators have earned over $2.4 million in the initial 24 hours.

Additionally, Pump.fun has become the top revenue-generating application over the last 24 hours, with $2.55 million, outpacing Hyperliquid (HYPE), a decentralized exchange.

Protocol ranking by revenue. Source: DeFiLlama

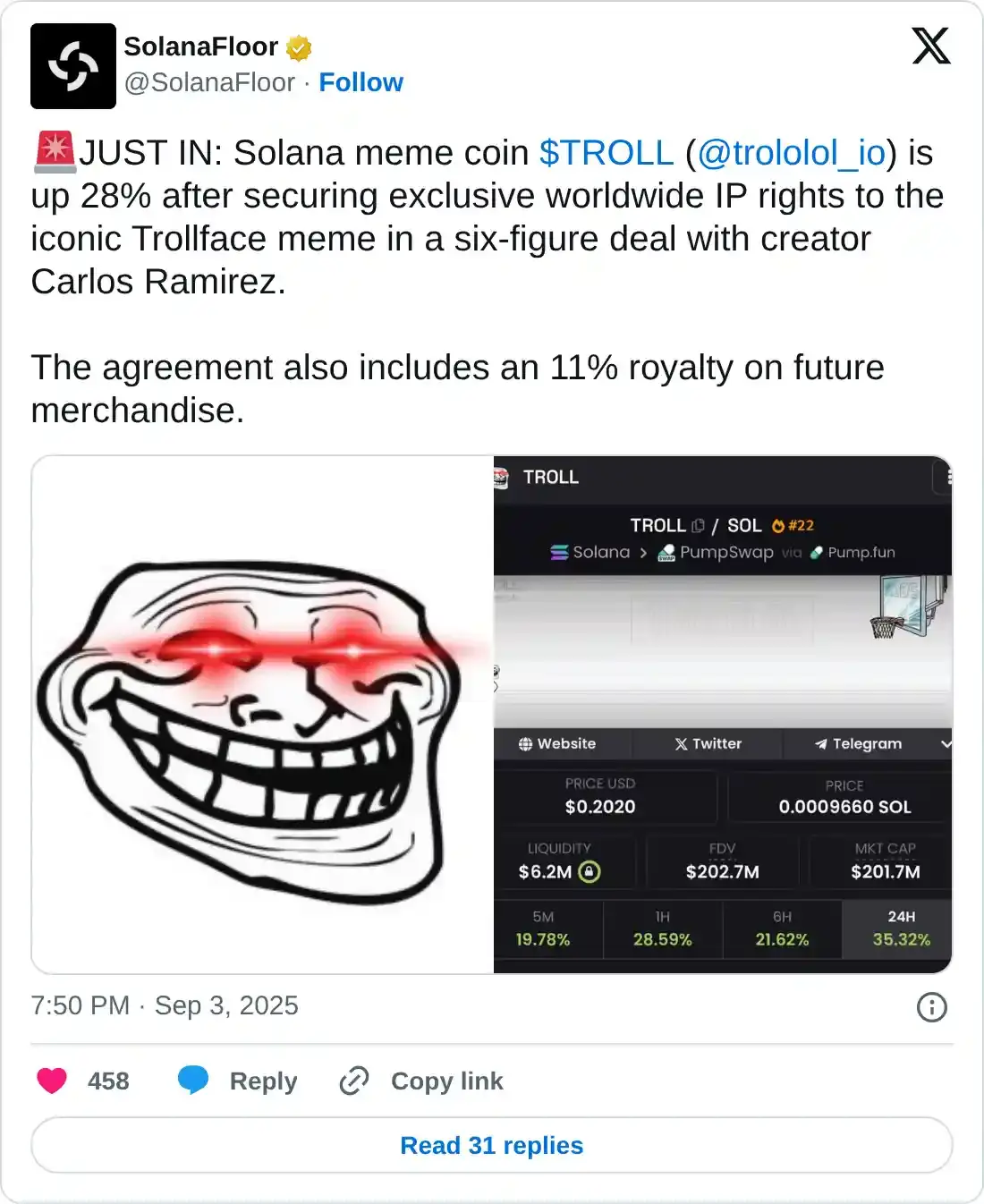

Notably, the Solana-based TROLL meme coin has reached a milestone by securing exclusive worldwide Intellectual Property (IP) rights for the popular Trollface meme after a high-value deal with creator Carlos Ramirez, including a royalty of 11%. The deal has sparked a double-digit rise in the TROLL spot price.

The revival of Solana-based meme coins could result in the second wave of momentum for the Solana network and its native token SOL.

Meme coins heat up the Solana network

The number of SPL tokens created on the Solana network reached 48,081 on Wednesday, the highest number since August 13, suggesting increased activity.

New SPL Tokens. Source: SolScan

Additionally, DeFiLlama shows the Total Value Locked (TVL) on Solana at $11.579 billion, inching closer to the record high of $11.989 billion set in January.

Solana TVL. Source: DeFiLlama

The liquidity boost on Solana is underpinned by an increasing stablecoin market capitalization reaching $12.267 billion, out of which Circle’s USDC dominates 69.40% following the recent mint of 250 million USDC on Wednesday.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy