Spacecoin and the Promise (and Pitfalls) of Banking the Unbanked

\ In 2021, approximately 1.4 billion adults remained unbanked globally, while 3 billion people still lack internet access. This creates a dual barrier: no bank account and no digital connectivity. Spacecoin proposes to break this cycle by combining satellites and blockchain technology—but is this innovation truly groundbreaking, or merely another ambitious project with more promise than proof?

Spacecoin's Vision: Satellites Meet Blockchain

Spacecoin aims to deliver financial services directly from orbit, merging decentralized banking with satellite-powered internet connectivity. Their concept of "space-based finance" represents more than marketing speak—it envisions the infrastructure for a borderless global financial system.

The model is ambitious:

- Low Earth Orbit (LEO) satellites provide 5G-equivalent coverage

- Users pay with cryptocurrency for essential data services (messaging, web browsing, micropayments)

- Subscription histories build on-chain credit profiles, enabling access to loans and advanced services

- At $2 monthly, the service targets communities excluded from both traditional banking and internet access

Market Context and Real-World Applications

Spacecoin's narrative overlooks a crucial detail: fintech has already reached millions across Africa and Asia without satellite infrastructure. Mobile money platforms like M-Pesa in Kenya and GCash in the Philippines transformed basic phones into banking terminals. The World Bank reports that digital payment adoption reduced unbanked populations by double digits within just a few years.

Where does satellite-based banking add genuine value? The applications likely center on:

- Ultra-remote regions lacking mobile tower infrastructure

- Areas experiencing government-imposed internet blackouts, where satellites bypass terrestrial controls

- Disaster recovery zones requiring resilient communication backups

Significant Challenges Ahead

Despite its futuristic appeal, Spacecoin faces substantial obstacles:

Hardware Accessibility: Even a $20 satellite device represents a significant expense for families surviving on $2 daily income.

Market Competition: Established players like SpaceX's Starlink and OneWeb already provide satellite internet services—can Spacecoin compete before achieving scale?

Regulatory Hurdles: Governments that restrict internet access to maintain control may not welcome unmonitored crypto-finance via satellite.

Cryptocurrency Volatility: If subscription fees fluctuate from $2 to $4 overnight due to token price swings, does this genuinely serve the unbanked population?

Technical Architecture Overview

The "blockchain in space" concept requires concrete implementation:

- Satellites create a mesh network architecture, eliminating single points of failure

- Smart contracts automate payment processing and subscription management

- Credit profiles recorded on-chain provide portable financial histories across borders

This framework theoretically transforms each subscriber into both customer and network participant. However, success depends on balancing processing speed, operational costs, and system reliability.

The Competitive Landscape

Spacecoin operates within a growing space finance sector:

- SpaceChain deployed blockchain nodes in orbit and developed "Tethys," a handheld satellite crypto device

- Blockstream Satellite broadcasts Bitcoin blockchain data globally as infrastructure redundancy

- JPMorgan and GomSpace conducted the first satellite-to-satellite tokenized transfer in 2021

The trend is clear: organizations from startups to major financial institutions view satellites as foundational infrastructure extending beyond Earth.

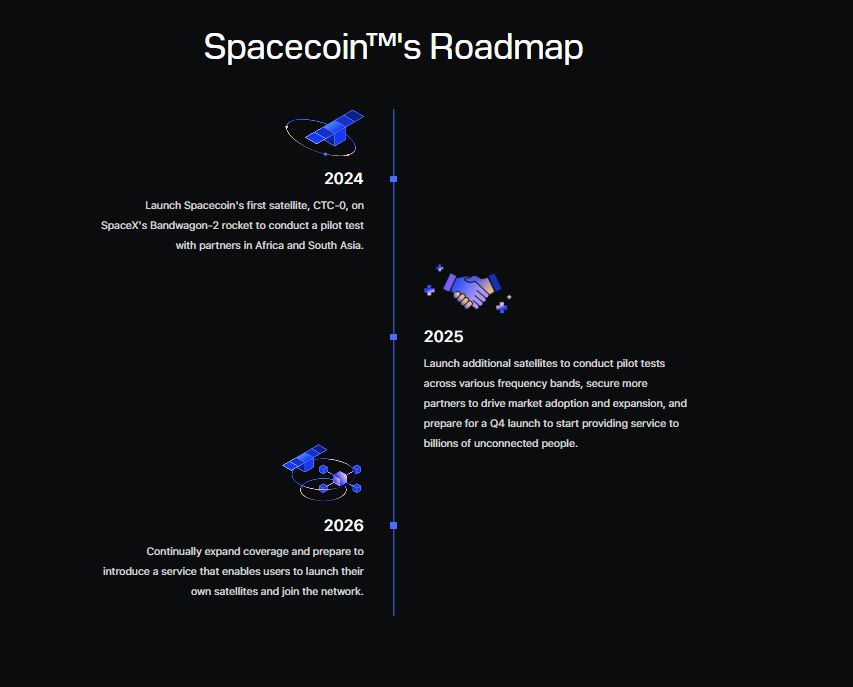

Roadmap and Reality Check

\ Spacecoin's near-term milestones include:

- 2024: Launch first satellite (CTC-0) via SpaceX rideshare program

- 2025: Multiple deployments with live service pilots in Africa and South Asia

- 2026: Enable end-users to contribute satellites to the constellation

While the timeline appears aggressive, ultimate success depends on genuine community adoption rather than merely achieving orbital deployment.

The Fundamental Question

Space-based finance holds transformative potential, but perspective matters. Sometimes a solar-powered cell tower and M-Pesa account solve accessibility challenges more effectively than satellite blockchain technology. Nevertheless, for regions where governments restrict connectivity or infrastructure simply doesn't exist, Spacecoin may offer more than speculative innovation.

The definitive test remains straightforward: will the farmer in rural Nigeria or the family in a remote Himalayan village actually adopt and benefit from this technology?

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more