According to PANews on October 27th, according to Lookonchain monitoring, trader 0xddc7, known for his 80% win rate, is currently facing over $3.3 million in unrealized losses on his short position of 668 BTC (approximately $76.8 million). To avoid forced liquidation, the trader added $1 million in USDC margin to Hyperliquid. After this additional increase, the forced liquidation price of its BTC short position was adjusted to US$118,410.According to PANews on October 27th, according to Lookonchain monitoring, trader 0xddc7, known for his 80% win rate, is currently facing over $3.3 million in unrealized losses on his short position of 668 BTC (approximately $76.8 million). To avoid forced liquidation, the trader added $1 million in USDC margin to Hyperliquid. After this additional increase, the forced liquidation price of its BTC short position was adjusted to US$118,410.

A trader with an 80% win rate faced a $3.3 million loss on his BTC short position and added another 1 million USDC to avoid liquidation.

2025/10/27 16:57

According to PANews on October 27th, according to Lookonchain monitoring, trader 0xddc7, known for his 80% win rate, is currently facing over $3.3 million in unrealized losses on his short position of 668 BTC (approximately $76.8 million). To avoid forced liquidation, the trader added $1 million in USDC margin to Hyperliquid.

After this additional increase, the forced liquidation price of its BTC short position was adjusted to US$118,410.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Share Insights

You May Also Like

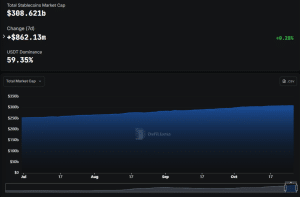

Ethereum “Remains In A Super Cycle” Amid Rising Stablecoin And Onchain Activity, Says Tom Lee

Tom Lee, the CIO of Fundstrat Capital and the Chairman of Bitmine Immersion Technologies, says that Ethereum “remains in a super cycle” as stablecoin demand [...]

Share

2025/10/27 18:37

Crypto Starts Recovery After $19B Crash, Ahead Of Trump Tariff Meeting

The post Crypto Starts Recovery After $19B Crash, Ahead Of Trump Tariff Meeting appeared on BitcoinEthereumNews.com. Cryptocurrency markets have staged a recovery after a record $19 billion liquidation event, buoyed by signs of a temporary ceasefire in the US-China trade war. Bitcoin (BTC) briefly recovered above a two-week high of $116,400 on Monday, driven by investor expectations of two significant macroeconomic catalysts this week: the incoming Federal Open Market Committee’s (FOMC) interest rate decision on Wednesday and a potential trade deal between the US and China, which could come as soon as Thursday. Crypto investor sentiment staged a recovery Monday from “fear” to “neutral” territory after reports emerged that the US and China had reached a “preliminary” framework for an import tariff deal. The rebound comes just days before US President Donald Trump and Chinese President Xi Jinping are set to meet on Thursday to discuss trade negotiations aimed at preventing further escalation between the world’s two largest economies. “Recent optimism surrounding the US-China trade negotiations helped ignite a weekend rally in Bitcoin. Signs of progress have lifted broader risk sentiment,” Wenny Cai, co-founder and chief operating officer at crypto derivatives trading platform SynFutures, told Cointelegraph. BTC/USD, 24-hour chart. Source: Cointelegraph Related: $19B crypto crash opens door to $200K Bitcoin in 2025: Finance Redefined US and China will “come away with the deal,” said President Trump Adding to the growing investor appetite, Trump said that he is optimistic the two nations will “come away with the deal” after Thursday’s meeting, according to a statement made aboard Air Force One on Monday, CNBC reported. The sign of de-escalation helped Bitcoin recover above the key short-term holder (STH) cost basis of about $114,000 for the first time since Trump’s renewed tariff threats resulted in the $19 billion crypto market crash at the beginning of October. Reclaiming this level is crucial for Bitcoin’s recovery, as the STH cohort is…

Share

2025/10/27 20:30

Tokyo’s Metaplanet Launches Miami Subsidiary to Amplify Bitcoin Income

Metaplanet Inc., the Japanese public company known for its bitcoin treasury, is launching a Miami subsidiary to run a dedicated derivatives and income strategy aimed at turning holdings into steady, U.S.-based cash flow. Japanese Bitcoin Treasury Player Metaplanet Opens Miami Outpost The new entity, Metaplanet Income Corp., sits under Metaplanet Holdings, Inc. and is based […]

Share

2025/09/18 00:32