Best Altcoins to Buy Before the Next Crypto Market Rebound

The meme coin market is showing early signs of a rebound for altcoins after a long consolidation phase.

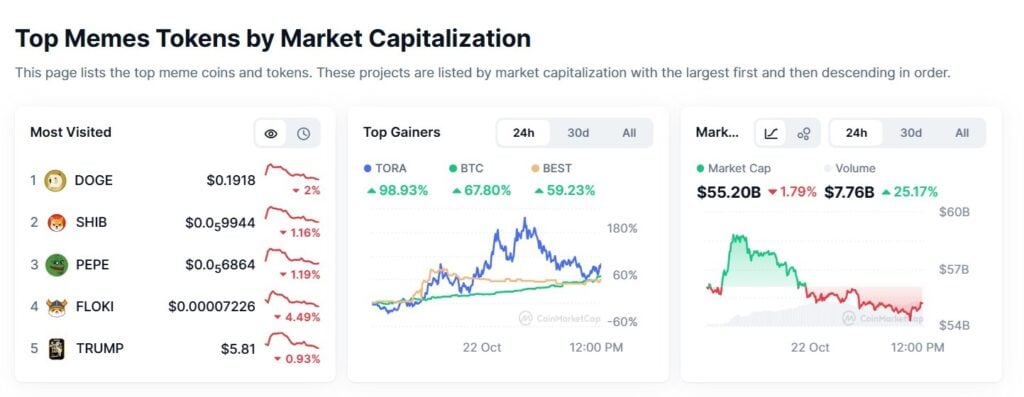

Although prices have declined over the past week and month, a recent rise in 24-hour trading volume suggests the market may be nearing a bottom around the $50 to $60 billion capitalization range.

Investors are now shifting their focus from established giants like Dogecoin and Shiba Inu, which may have already peaked, to new, high-potential altcoins that could deliver strong gains in the next rally.

Two standout names right now are Bitcoin Hyper and Snorter Token, both combining strong hype with innovative technology and fast-growing communities.

Source – 99Bitcoins YouTube Channel

Bitcoin Hyper (HYPER)

Bitcoin Hyper is changing how people use Bitcoin. It’s a new scaling solution that makes transactions faster, cheaper, and smarter. It combines Bitcoin’s strong security with the speed of the Solana Virtual Machine (SVM).

Instead of filling up Bitcoin’s main blockchain, Bitcoin Hyper handles transactions on its own Layer-2 network. It groups them together and sends them back to Bitcoin using zero-knowledge (ZK) rollups. This approach increases speed while keeping the network decentralized.

Bitcoin Hyper also has a canonical bridge that lets users lock their BTC on Bitcoin and mint the same amount of wrapped BTC on Bitcoin Hyper. This setup allows instant, low-cost transfers without losing control of your BTC, and you can redeem it anytime.

The project’s goal is to make Bitcoin more useful. By adding smart contract support through the SVM, developers can now build DeFi apps, NFT marketplaces, and even meme coins on Bitcoin.

At the center of this system is the $HYPER token, which mixes real utility with meme appeal. Holders use $HYPER to pay transaction fees, stake for up to 48% APY, and vote on governance proposals once the project’s DAO launches.

$HYPER’s token design also reflects Bitcoin’s roots. It has a total supply of 21 billion tokens, mirroring Bitcoin’s 21 million limit. About 20% is set aside for marketing, and 10% will fund exchange listings.

Analyst Cilinix Crypto praised this setup, calling $HYPER one of the best altcoins to buy for long-term growth.

So far, the $HYPER presale has raised around $24.5 million, with tokens currently priced at $0.013155. Investors can buy using ETH, USDT, BNB, or even a bank card, making it easy to participate.

The project’s smart contract audit by Coinsult and SpyWolf adds another layer of trust and has already attracted the attention of crypto whales.

Visit Bitcoin Hyper

Snorter Token (SNORT)

If crypto trading feels unfair or out of reach, Snorter Token (SNORT) aims to level the playing field.

The team is building Snorter Bot, a crypto trading tool that works directly inside Telegram. With just a few taps, users can snipe new tokens, buy, sell, and manage their portfolios without leaving the app.

Snorter Bot also includes rug pull and honeypot detection, a feature that helps traders avoid scams when exploring new projects. This protection makes it easier to find safe and promising tokens in a fast-moving market.

Using Snorter Bot gives traders a real edge against whales. It lets users snipe confidently while keeping their funds secure from scams and hacks.

Holding the native $SNORT token unlocks the best features of the bot. Token holders enjoy lower fees, faster snipes, and other exclusive perks. Each token costs just $0.1081, making it an affordable entry for those looking to boost their trading power.

The Snorter Token presale has already raised around $5.3 million, showing strong interest from traders who see its potential.

Many now view it as one of the best altcoins to buy in the current market. Investors can also stake $SNORT to earn rewards of up to 102% per year, a great way to grow holdings passively.

This is a crucial moment for traders. The clock is ticking, and in just 5 days, the Snorter Token presale will close. If you’ve been watching Snorter and haven’t joined yet, now is the time to move. Once $SNORT lists on exchanges, its price will likely rise far above the presale level.

Visit the Snorter Token website and buy $SNORT using ETH, BNB, USDT, or even a credit card before the presale ends.

Visit Snorter Token

Conclusion

Altcoins are beginning to regain momentum, and the next market rebound could separate projects with real innovation from short-lived hype. Bitcoin Hyper and Snorter Token both stand out for building actual utility into the meme and trading space, something this market rarely sees.

As Bitcoin prepares for another potential rally, these two projects are already capturing investor attention for the right reasons: technology, scalability, and active communities.

Whether it is Bitcoin Hyper unlocking speed and DeFi on Bitcoin or Snorter Token giving everyday traders the same tools as whales, both reflect where the next phase of crypto is heading with real use cases backed by early momentum.

For investors looking beyond the noise, these may not just be the best altcoins to buy, but potential frontrunners in the next crypto market rebound.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Fed rate decision September 2025

3 Paradoxes of Altcoin Season in September