Best Crypto Presales to Buy Now as Bitwise CIO Compares Bitcoin to Gold

In a thread he posted on X, Hougan said that Bitcoin’s $2.3 trillion valuation makes sense when compared to the $25 trillion gold market it’s targeting. Meanwhile, Ethereum and Solana aim to capture even larger financial and payments ecosystems, worth hundreds of trillions globally.

The key takeaway? Crypto’s current valuations may seem inflated at first glance. Make no mistake, though, they’re still small compared to the industries these networks could disrupt.

As institutions continue to accumulate $BTC, $ETH, and $SOL, retail traders are shifting into early-stage presales that align with similar macro trends: sound money, infrastructure, and scalability.

Three emerging projects could now lead the next speculative wave: Bitcoin Hyper ($HYPER), Snorter Token ($SNORT), and BlockchainFX ($BFX).

Bitcoin Hyper ($HYPER): Digital Gold Reimagined

As Bitwise CIO Matt Hougan notes, Bitcoin is competing directly with gold’s $25T market. And now, that same “digital gold” thesis is evolving through Bitcoin Hyper ($HYPER).

Built as a Layer 2 network on Bitcoin, $HYPER combines Bitcoin’s unmatched decentralization with Solana’s lightning-fast throughput, enabling fast, low-cost, and energy-efficient transactions.

Unlike Bitcoin’s heavy carbon footprint, $HYPER uses minimal energy, making it a scalable and sustainable option for the next wave of adoption.

Its presale has already raised nearly $20M, with tokens currently priced at $0.013015 and offering up to 60% APY staking rewards. This is designed to attract both long-term holders and active yield seekers, and given the project’s early traction, this incentive seems to be working.

The investment angle is apparent: Bitcoin Hyper ($HYPER) represents “digital gold with velocity”: combining Bitcoin’s core principles with the transactional efficiency that institutions and traders demand.

As Bitcoin’s macro narrative resurges, $HYPER stands as its modern, high-performance counterpart and a clear next stage in Bitcoin’s evolution. And for a project of its scope, a valuation of less than $20M is certainly undervalued.

Join the Bitcoin Hyper ($HYPER) presale before the crowd catches on!

Snorter Token ($SNORT): Meme Utility for Traders

Snorter Token ($SNORT) bridges the gap between meme culture and professional trading, combining humor with versatile on-chain trading tools.

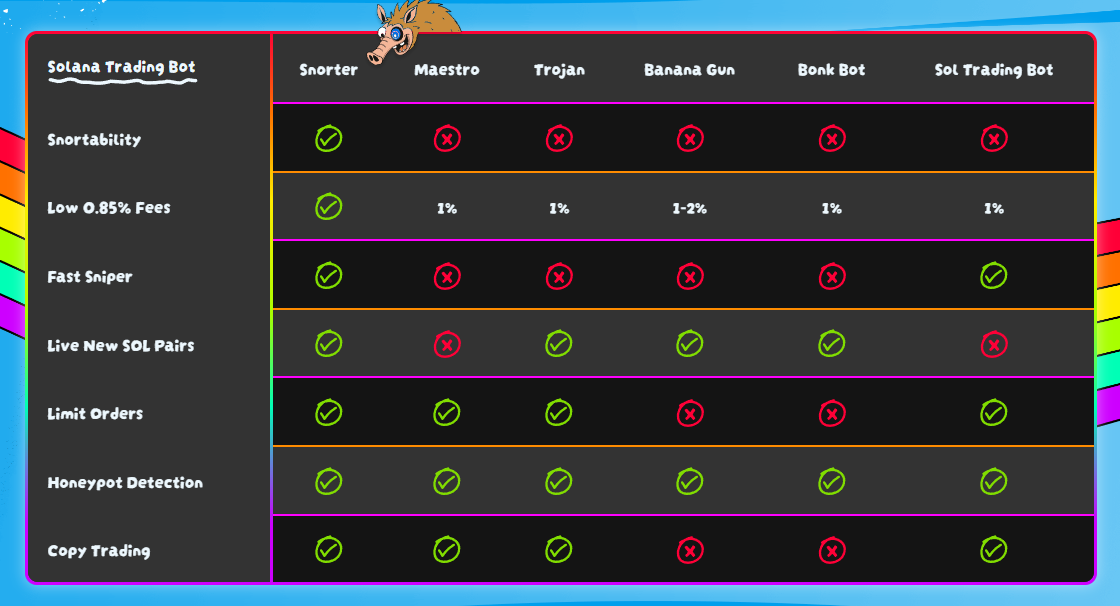

Its Telegram-native Solana trading bot enables sub-second sniping, scam-detection, and automated copy trading. By using the Snorter Bot, users gain a tactical edge while keeping the experience fun and community-driven.

The project has already raised over $4M in presale funding, with tokens currently available at $0.1065 each, and staking rewards offering up to 113% APY. With over $22M in $SNORT currently being staked, it’s clear that user confidence and long-term engagement are very much present.

Snorter Token ($SNORT) is the perfect high-risk, high-reward meme-utility hybrid, perfectly positioned for the Solana trading cycle, and designed to thrive as retail momentum builds. At a current valuation of around $4M, it’s a no-brainer.

With rival Telegram-native trading bots like Banana Gun ($BANANA) having hit an all-time-high market capitalization of around $240M, Snorter Bot’s more advanced trading tools and meme-driven branding could mean huge upside potential if adoption continues to accelerate.

Participate in the $SNORT presale while it’s still undervalued!

BlockchainFX ($BFX): The Tokenized Assets Presale

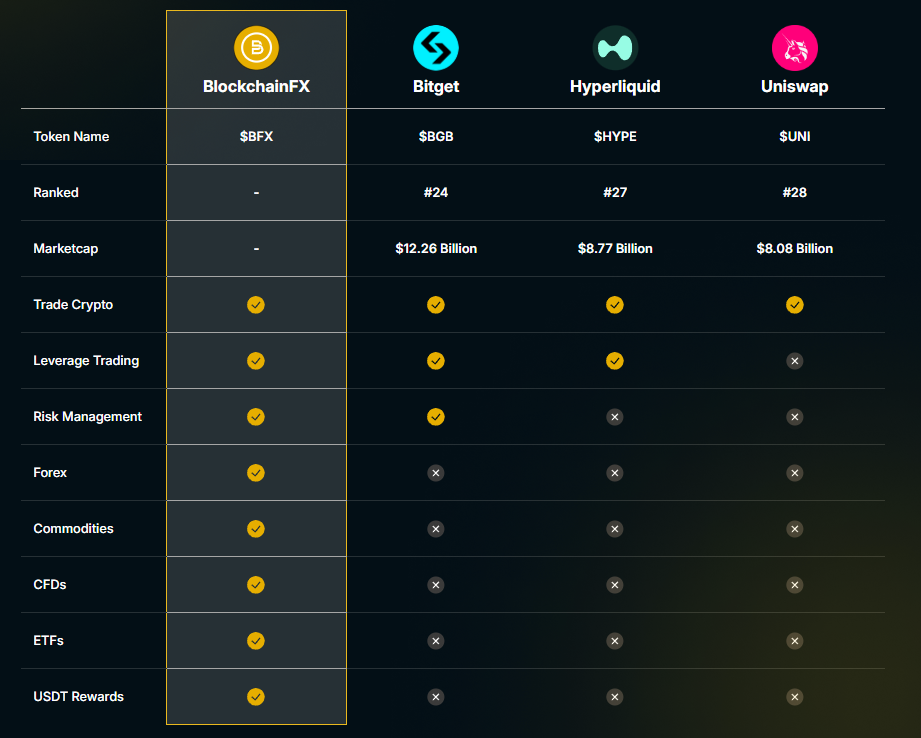

BlockchainFX ($BFX) is emerging as a presale built directly in line with Matt Hougan’s thesis: that Ethereum and Solana are reshaping trillion-dollar financial markets through tokenization.

The project targets the $600T+ global securities and payments sector, aiming to become the Web3 trading layer for tokenized stocks, bonds, and commodities.

The BlockchainFX platform integrates AI-powered analytics, real-time on-chain settlement, and compliance-ready tokenization tools, bridging the gap between DeFi and TradFi.

Presale momentum is also rising rapidly, as investors seek exposure to the tokenized assets boom driving this year’s crypto narratives. With institutions moving into blockchain-backed financial infrastructure, $BFX offers a rare retail opportunity to participate in that evolution.

The investment angle is clear: $BFX is a long-term, utility-driven presale that is well placed to form part of the infrastructure backbone for the next generation of digital markets, where blockchain meets Wall Street.

Click here to learn more about BlockchainFX ($BFX)!

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Best Crypto Presales to Buy Now as Bitwise CIO Compares Bitcoin to Gold appeared first on Coindoo.

You May Also Like

Russia’s monetary authority to survey crypto investments

Best Sit and Go Poker Sites – Where to Play SNG Poker Tournaments in 2025