Best Crypto to Buy: Why Digitap ($TAP) Is the Clear Winner Over Remittix and BlockDAG

Three names are emerging among the new entrants: Digitap ($TAP), Remittix, and BlockDAG.

Although there are different benefits to each one, it is Digitap that is pulling ahead. Available today for just $0.0125 per token, it is considered one of the most attractive entry points for investors willing to hold for the long term. Here’s everything investors need to know about the world’s first omni-bank.

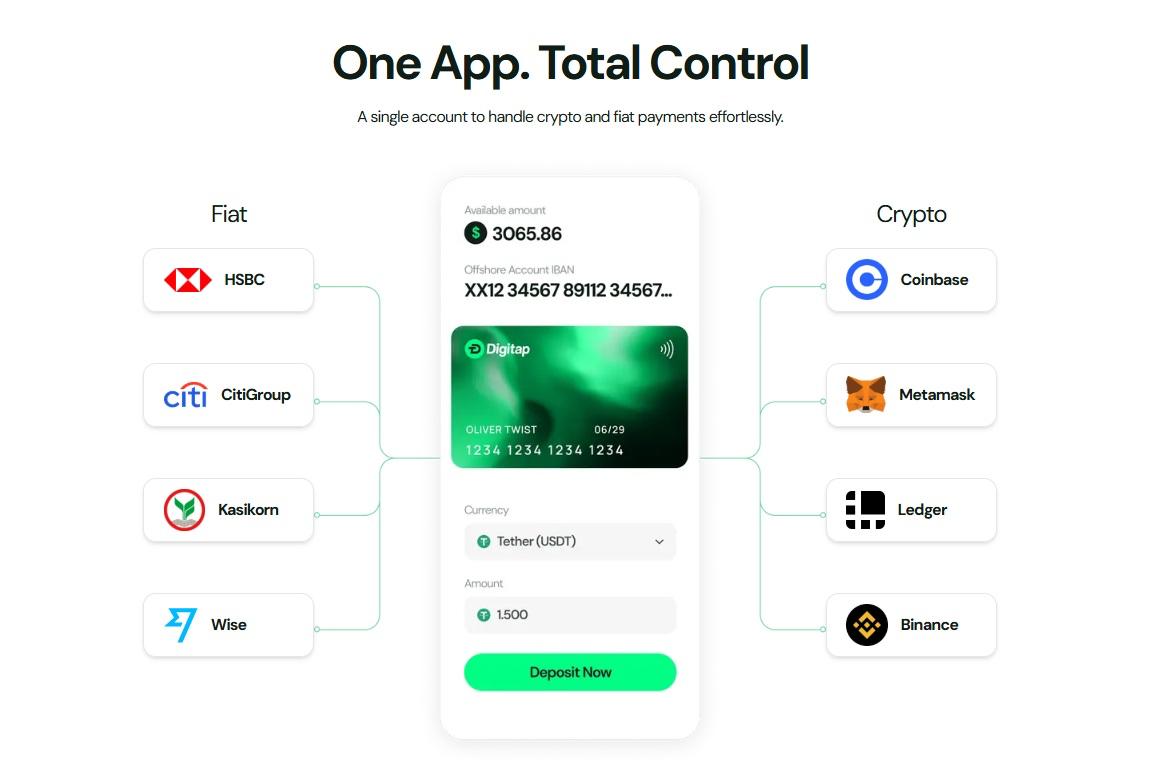

Digitap: A Complete Banking–Crypto Ecosystem

Digitap is the leader of the pack because it is not just an idea and already has a fully functional app that is accessible to users now. This single point of view instantly differentiates it from projects that are still months off from delivery.

Users can apply for its Visa-backed card, which serves as an alternative to a regular card and is available in both physical and virtual formats. It is compatible with Apple Pay and Google Pay, has no limit on the number of cards, and allows users to create their own designs to be printed on the cards.

Signing up is hassle-free, takes no more than 5 minutes, and most importantly, is non-KYC. For freelancers, the unbanked, and those who are fed up with financial institutions’ control, Digitap is the solution.

Its omni-banking service offers deposits, withdrawals, transfers, and exchanges all in a single interface—and Overseas Accounts featuring offshore IBANs for enhanced discretion and security. Behind the scenes, AI Smart Routing by Digitap guarantees the use of the most effective channel for transfers and swaps, whether that be traditional banking rails or blockchain.

Remittix: Bridging Crypto to Fiat Networks

Through its PayFi system, Remittix aims to serve as the bridge between cryptocurrency and conventional banking. Users can transfer the fiat to bank accounts anywhere in the world just by linking their crypto wallet.

One of the project’s early milestones is its beta Web3 wallet, which is now live and supports major networks, including Bitcoin, Ethereum, and Solana. Additionally, Remittix provides real-time conversion between crypto and fiat, and this service is valid for all thirty countries where the platform allows trading in forty cryptocurrencies. Its hybrid structure is intended to achieve lightning-fast settlement.

The project is still in development and has not yet reached its full potential, but Remittix has already found a practical application. This explicit and effective use gives the project credibility and makes it a formidable participant in the payments field.

BlockDAG: Technical Ambition with Scalability Focus

The project doesn’t rely on traditional blockchain structures, but rather on a Directed Acyclic Graph (DAG) model. It aims to increase throughput, achieve faster transaction settlement times, and support scalability to levels that cannot be reached by conventional chains.

The BlockDAG presale is live now. Its first rounds are selling BDAG tokens for approximately $0.0016, with $415 million raised so far. To instill confidence in investors and developers, the project has already undergone two independent security audits for its smart contracts and code base. Further, BlockDAG has prepared a demo trading platform ahead of its mainnet launch for users to test the BDAG performance when it is listed on exchanges.

BlockDAG is strictly focused on finding solutions to the technical problems it encounters and will not deliver any consumer-ready products at this time. It is concentrating on the scalability and high-volume performance of the project. BlockDAG will become the key infrastructure of dApps in the future if the team continues to fulfill its promises.

Why Digitap Is the Clear Winner

Both the Remittix and BlockDAG projects have the potential to positively impact the market. Remittix could reduce the cost of remittances, whereas BlockDAG could speed up the blockchain. However, Digitap already has these virtues in a single product that is available for download and use by the public today.

Its special benefits are:

- Live Product: Unlike other similar products, Digitap is not selling future projects as it is already operational.

- Privacy & Control: No-KYC onboarding, stealth mode privacy, and no data tracking.

- Full Integration: From offshore accounts to AI-driven currency routing, it is one ecosystem for all financial needs.

- Massive Market Fit: Positioned to capture a slice of the $250 trillion cross-border payments market, the $860 billion remittance market, and the 1.4 billion unbanked population.

- Attractive Entry Point: At just $0.0125 per TAP, the token offers early investors a chance to ride a potential 20x or higher growth if adoption accelerates.

In short, Digitap balances usability, scale, and adoption readiness. This not only makes it the best crypto buy of the three but also one of the most compelling tokens in the market today.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://Digitap.app

Social: https://linktr.ee/digitap.app

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Best Crypto to Buy: Why Digitap ($TAP) Is the Clear Winner Over Remittix and BlockDAG appeared first on Coindoo.

You May Also Like

Kalshi debuts ecosystem hub with Solana and Base

Only a Few Crypto Treasuries Will Survive, Warns Coinbase Research Chief