Bitcoin ETFs Break 6-Day Outflow Streak, Record $240M Inflows as BTC Holds Above $102k

- Bitcoin ETFs see renewed inflows with $240 million recorded on November 6 while the total value traded “sits” at $4 billion.

- BlackRock’s IBIT dominated the net inflows with more than $100 million added, followed by Fidelity’s FBTC.

The US spot Bitcoin (BTC) Exchange Traded Fund (ETF) broke its six-day outflow streak on November 6, which had seen more than $660 million withdrawn from the market.

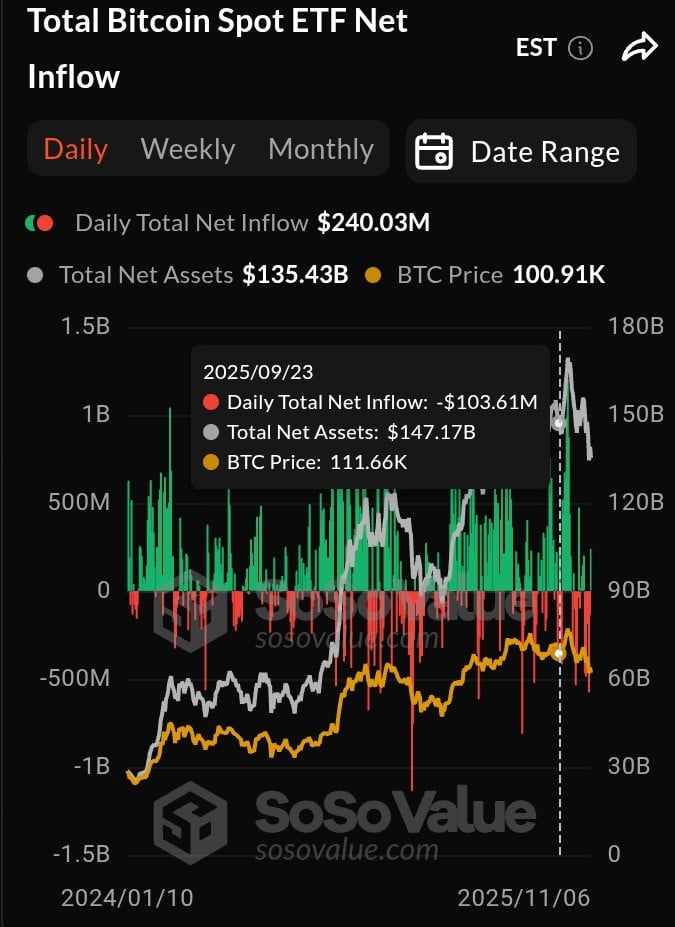

Exploring data from the analytics platform SoSoValue, we discovered that the Bitcoin ETF has finally recorded a daily net inflow of $240 million. We also found that the cumulative total net inflow, as of November 6, was $60.5 billion.

This brings the total net assets across all spot Bitcoin ETFs to $135.4 billion, representing 6.7% of the total Bitcoin market cap. On the day under review, the ETF value traded was around $4 billion, according to SoSoValue.

Source: SoSoValue

Source: SoSoValue

Individual Contributions to Bitcoin ETF Inflows

Taking a critical look at the individual performance, CNF discovered that BlackRock’s iShares Bitcoin Trust (IBIT) made the most contribution with $112.4 million in net inflows. This was followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC), which recorded net inflows of $61.6 million.

Ark Invest’s ARKB followed closely with $60 million, while Bitwise’s BITB also added $5.5 million. Meanwhile, Grayscale Bitcoin Trust (GBTC), VanEck’s HODL, Invesco’s BTCO, and other smaller funds had “zero net inflows.”

This data suggests that BlackRock continues to dominate this sector as its fund now accounts for over $100 billion in total net assets, as detailed in our earlier news brief. It is also important to note that IBIT has contributed more than half of all Bitcoin ETF inflows since January 2024.

What This Means to the Market

The sudden break of the outflow streak indicates that positive sentiment may have returned to the Bitcoin market. This is evident in the rising traders’ interest as its daily trading volume rises by 15%. Meanwhile, the price remains slightly above its crucial support line, as noted in our earlier publication.

At the time of writing, the price of Bitcoin was hovering around the $101.9k level. The price has also declined by 1.2% in the last 24 hours and 6% in the last seven days.

According to Bitwise Chief Investment Officer Matt Hougan, this pullback is necessary for its next rally as it almost approaches the final stage of the “retail flushout.” He believes that while retailers appear to have lost enthusiasm, institutions and financial advisors are excited about the long-term potential.

Echoing similar sentiments, some analysts have predicted that Bitcoin could hit $160k before Christmas. As highlighted in our earlier discussion, institutional adoption, historical post-halving patterns, and macroeconomic shifts could drive this. Fascinatingly, our previous analysis indicated that this prediction could hold once the asset makes a decisive move above $110k.

]]>You May Also Like

8.18 Million Solana Committed on CME as SOL Options Prepare to Go Live

BounceBit plans to use platform fees for BB repurchase