Brazilian Lawmaker Proposes Scrapping Crypto Tax for Long-term Investors

The Brazilian lawmaker Eros Biondini has created a draft bill that proposes doing away with crypto tax, particularly in the case of citizens who hold Bitcoin (BTC) as a long-term store of value.

The MP has filed his bill in the Chamber of Deputies, the Portuguese-language media outlet Livecoins reported.

Brazilian Crypto Tax: Could Levies Be Scrapped?

The bill calls for the removal of the clauses in the tax code that explicitly mention the taxation of cryptoassets.

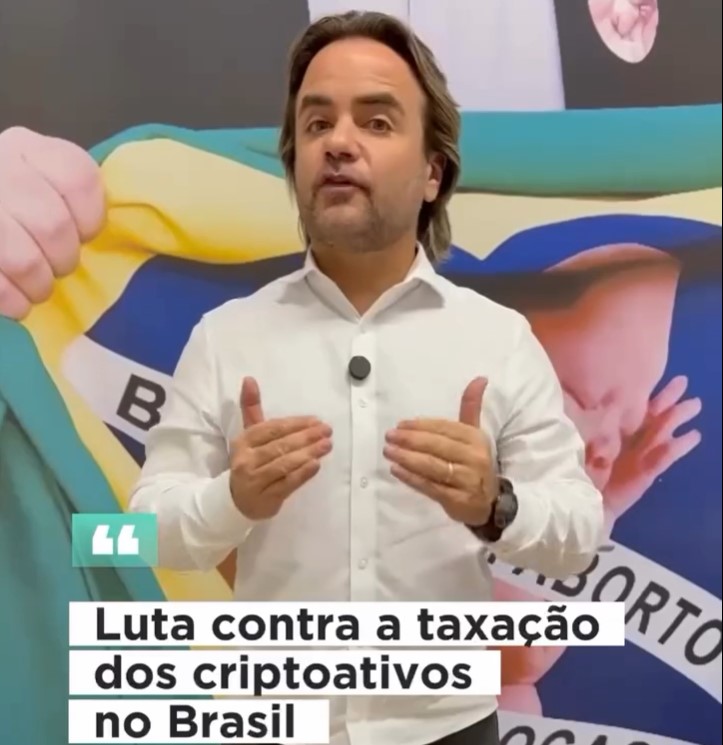

The Brazilian lawmaker Eros Biondini calling for support for his bill on social media. The caption reads: “Fight against the taxation of cryptoassets in Brazil.” (Source: @erosbiondini/Instagram)

The Brazilian lawmaker Eros Biondini calling for support for his bill on social media. The caption reads: “Fight against the taxation of cryptoassets in Brazil.” (Source: @erosbiondini/Instagram)

It also calls for the abolition of a 2023 law that spells out the means of collecting income tax from profits derived from cryptoassets.

The bill will first be assessed by a Chamber of Deputies committee. The committee will decide whether or not to pass the bill on to the lower house.

From there, it could then move on to the Senate and the office of the President. Both the Senate and the President would have the power to veto the bill.

Biondini also claims that new taxes on financial transactions, including foreign exchange and insurance transfers, are ill-timed.

He claimed that imposing a new tax burden on the population at “a time of economic fragility” would have negative consequences.

The lawmaker noted that the Brazilian tax “burden” reached 32.32% of the country’s Gross Domestic Product (GDP) in FY2024. This is the tax-to-GDP ratio’s highest rate in the last 15 years, per Treasury data.

Biondini criticized the government’s crypto policy. He complained that Brazil, “instead of leading” the world in crypto adoption, is now “going against the grain.”

He said existing and future crypto tax laws “penalize people who are looking for a legitimate, safe, and sovereign store of value.”

Formal Recognition for BTC Savers

The crypto-adovocating lawmaker has previously authored a bill that seeks to formally recognize Bitcoin as a strategic store of value in Brazil.

This proposal seeks to create tax exemption for BTC buyers and holders. It also seeks to spell out citizens’ rights to become self-custodians of their coins, without having to rely on crypto wallet operators.

Biondini took to social media last week in an attempt to unite the Brazilian crypto community behind his bill.

He suggested that if the topic were to go viral, the lower house would be pressured to reject efforts to boost crypto tax revenues in Brazil.

Biondini also called on fellow parliamentarians to back his bill. He explained that it had been designed to defend taxpayers, industry players, and Brazil’s “economic sovereignty.”

In November last year, Biondini unveiled a bill proposing the creation of a national Bitcoin reserve.

The plan called for the government to convert up to 5% of Brazil’s $372 billion international reserve fund to Bitcoin.

You May Also Like

Avalanche Jumps 10% While Market Sinks—MAGAX Presale Targets 1,350% Upside

HYPE Price Prediction: ASTER vs HYPE Battle Heats Up as Analysts Call HYPE “Golden Buy” at $42 – Who Wins?