PANews reported on November 3rd that, according to a Ministry of Finance announcement, the "Announcement on Relevant Tax Policies for Gold" will be officially implemented from November 1st, 2025 to December 31st, 2027, clarifying the value-added tax (VAT) collection standards for "investment gold" and "non-investment gold." The new regulations classify gold types based on "purity + function," aiming to regulate the market, curb arbitrage, and reduce the cost of compliant investment. Industry experts say this move will guide funds towards highly liquid products such as standard gold and ETFs, and will have no direct impact on ordinary consumers.PANews reported on November 3rd that, according to a Ministry of Finance announcement, the "Announcement on Relevant Tax Policies for Gold" will be officially implemented from November 1st, 2025 to December 31st, 2027, clarifying the value-added tax (VAT) collection standards for "investment gold" and "non-investment gold." The new regulations classify gold types based on "purity + function," aiming to regulate the market, curb arbitrage, and reduce the cost of compliant investment. Industry experts say this move will guide funds towards highly liquid products such as standard gold and ETFs, and will have no direct impact on ordinary consumers.

Experts analyze that the latest gold transaction tax policy has no direct impact on ordinary consumers.

2025/11/03 08:31

PANews reported on November 3rd that, according to a Ministry of Finance announcement, the "Announcement on Relevant Tax Policies for Gold" will be officially implemented from November 1st, 2025 to December 31st, 2027, clarifying the value-added tax (VAT) collection standards for "investment gold" and "non-investment gold." The new regulations classify gold types based on "purity + function," aiming to regulate the market, curb arbitrage, and reduce the cost of compliant investment. Industry experts say this move will guide funds towards highly liquid products such as standard gold and ETFs, and will have no direct impact on ordinary consumers.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Share Insights

You May Also Like

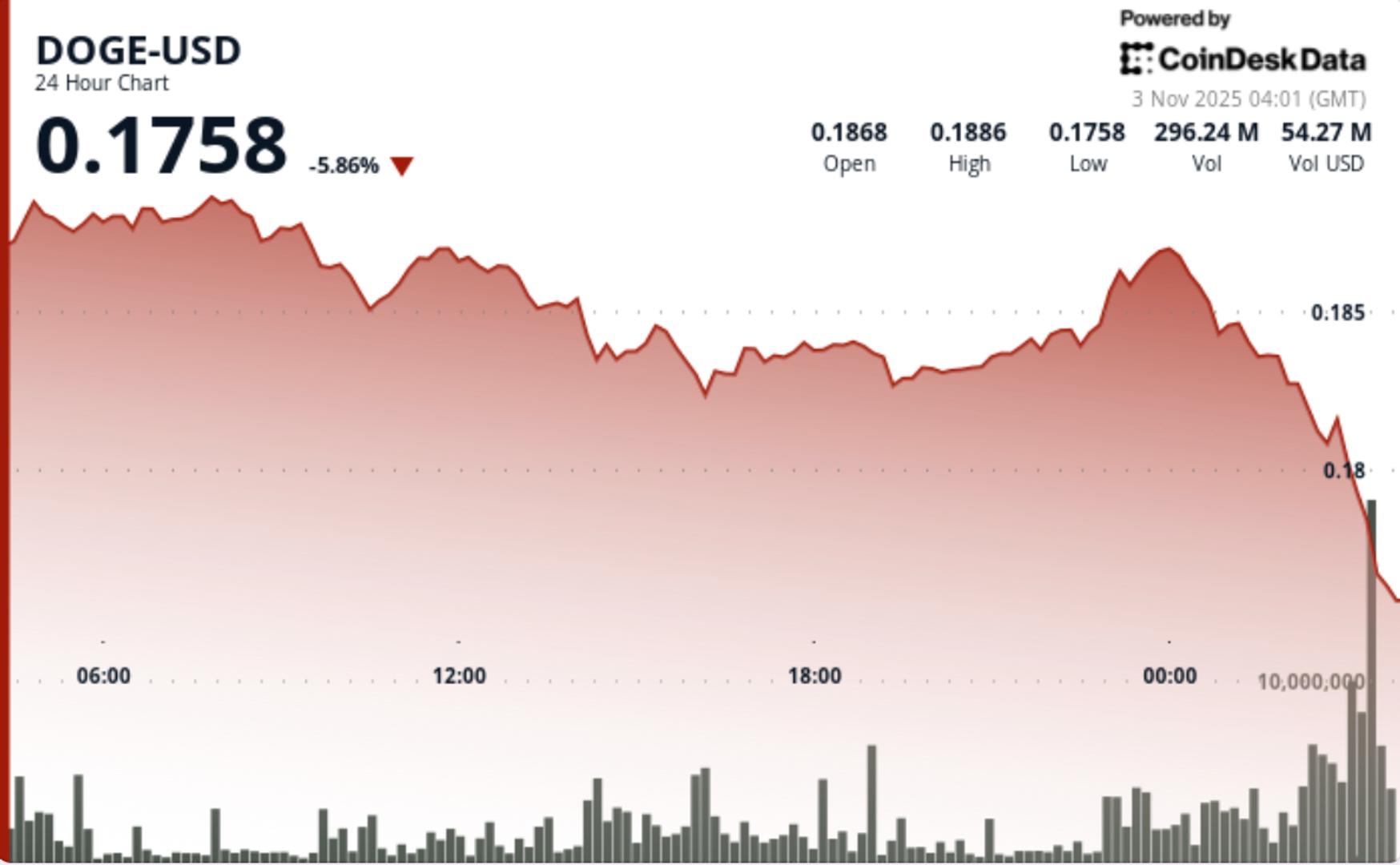

DOGE Falls to $0.18 as Long-Term Holders Exit, 'Death Cross' Price Action Appears

The decline came amid a deteriorating technical backdrop and increased selling activity across large wallets.

Share

Coinstats2025/11/03 12:11

Crypto Prices Slip Ahead of US Jobs Data as Bessent Flags Rate Risks

Crypto slipped in thin weekend trade as investors prepared for U.S. jobs data and weighed comments from Treasury Secretary Scott Bessent.

Share

Coinstats2025/11/03 11:50

The Hong Kong Securities and Futures Commission (SFC) allows licensed virtual asset trading platforms to share their listing lists with overseas platforms and has established a compensation mechanism.

PANews reported on November 3 that the Hong Kong Securities and Futures Commission (SFC) issued a circular regarding the sharing of liquidity among virtual asset trading platforms. This circular allows licensed virtual asset trading platform operators to integrate their listings with qualified overseas platform operators to share liquidity, enabling cross-platform trading and execution. Platforms must adopt Direct Verification (DVP) for both payment and banking, and monitor the limits on intraday settlement and unsettled transactions. They must also establish a reserve fund and insurance / indemnification arrangements in Hong Kong with a minimum limit to cover settlement asset risks. Market surveillance must be uniformly implemented and able to provide real-time transaction and customer data to the SFC. Before targeting retail markets, platforms must provide full risk disclosure and obtain customer selection, simultaneously applying for written approval, along with additional terms and conditions.

Share

PANews2025/11/03 12:48