Intel’s foundry business keeps losing billions with no turnaround in sight

Intel’s stock shot up 30% on Thursday after Nvidia revealed it was buying a $5 billion stake, as Cryptopolitan reported. But the hype around that investment ignores one big problem: Intel’s foundry business is still losing money… a lot of it. That part of the company wasn’t even mentioned in the deal. Not once. And that silence says everything.

The agreement gives Nvidia a 4% stake in Intel. It also lets Nvidia use Intel’s CPUs in its AI data center servers. On the flip side, Intel will start using Nvidia’s AI tech inside its personal computer chips. The plan sounds clean on paper.

But it completely avoids the area most investors and Washington have been worried about for years — Intel’s contract chipmaking unit, Intel Foundry Services. And no, this isn’t some small side operation. This is the division that’s bleeding billions of dollars, year after year.

Intel’s foundry business keeps losing billions with no turnaround in sight

Intel used to only make chips for itself. But in 2021, then-CEO Pat Gelsinger opened up the company’s manufacturing to outside clients. That’s when Intel Foundry Services was born. The idea was to spend hundreds of billions of dollars building new factories so Intel could produce chips for other companies. It was supposed to be a comeback play after Intel started losing market share. But the plan didn’t work.

The business failed to attract major customers. As a result, Intel Foundry Services lost $7 billion in 2023. And in 2024, the losses jumped to $13 billion. That’s nearly double in one year. These numbers spooked investors and crushed the company’s stock. Intel’s shares plunged 60% last year. By December, Pat was out. The board fired him.

Wall Street analysts are still worried. Angelo Zino from CFRA said, “This is a business that will continue to bleed cash at least through 2027.” Chris Danely from Citi downgraded Intel the day after Nvidia’s announcement. He said the rally was overhyped and that the foundry division has “minimal chance to succeed.”

Some experts want Intel to just sell the foundry unit and cut their losses. Others warn that doing that would push Intel’s own chip production costs even higher, because they’d lose the scale that helps keep prices low. Either way, no one sees a good outcome right now.

Nvidia skipped Intel’s factories and went with TSMC instead

At a press briefing about the deal, Nvidia CEO Jensen Huang and Intel CEO Pat Kissinger were asked if Nvidia planned to use Intel’s factories. Both said maybe, someday. But they also made it clear that, for now, they’ll keep working with TSMC — Intel’s main rival — to build their new chips.

That’s a major snub. Especially since Nvidia’s whole supply chain is tied up in Taiwan, and the US government has been pushing hard for companies to diversify. Some had expected this deal to come with a manufacturing arrangement — especially since Intel supplies chips to the Pentagon and is the only large-scale US-based chipmaker doing advanced manufacturing. But no such deal happened.

Anshel Sag from Moor Insights & Strategy told Yahoo Finance, “I was expecting that Nvidia was going to announce some sort of contract manufacturing deal with Intel, with the US government’s involvement.” It didn’t happen. Nvidia didn’t commit to Intel Foundry Services. They didn’t even test it. Just silence.

The US government recently bought a 10% stake in Intel, showing how much Washington cares about keeping Intel’s manufacturing alive. Right now, most cutting-edge chips are made by TSMC in Taiwan. TSMC is building plants in the US, but its core research and capacity are still overseas. That’s a huge risk, especially with China looming.

Still, Zino said the Nvidia-Intel partnership could help a little. It might make Nvidia more open to testing Intel’s foundry later. “You potentially see Nvidia start giving some token business to Intel,” he said.

For now, though, that token isn’t on the table.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free.

You May Also Like

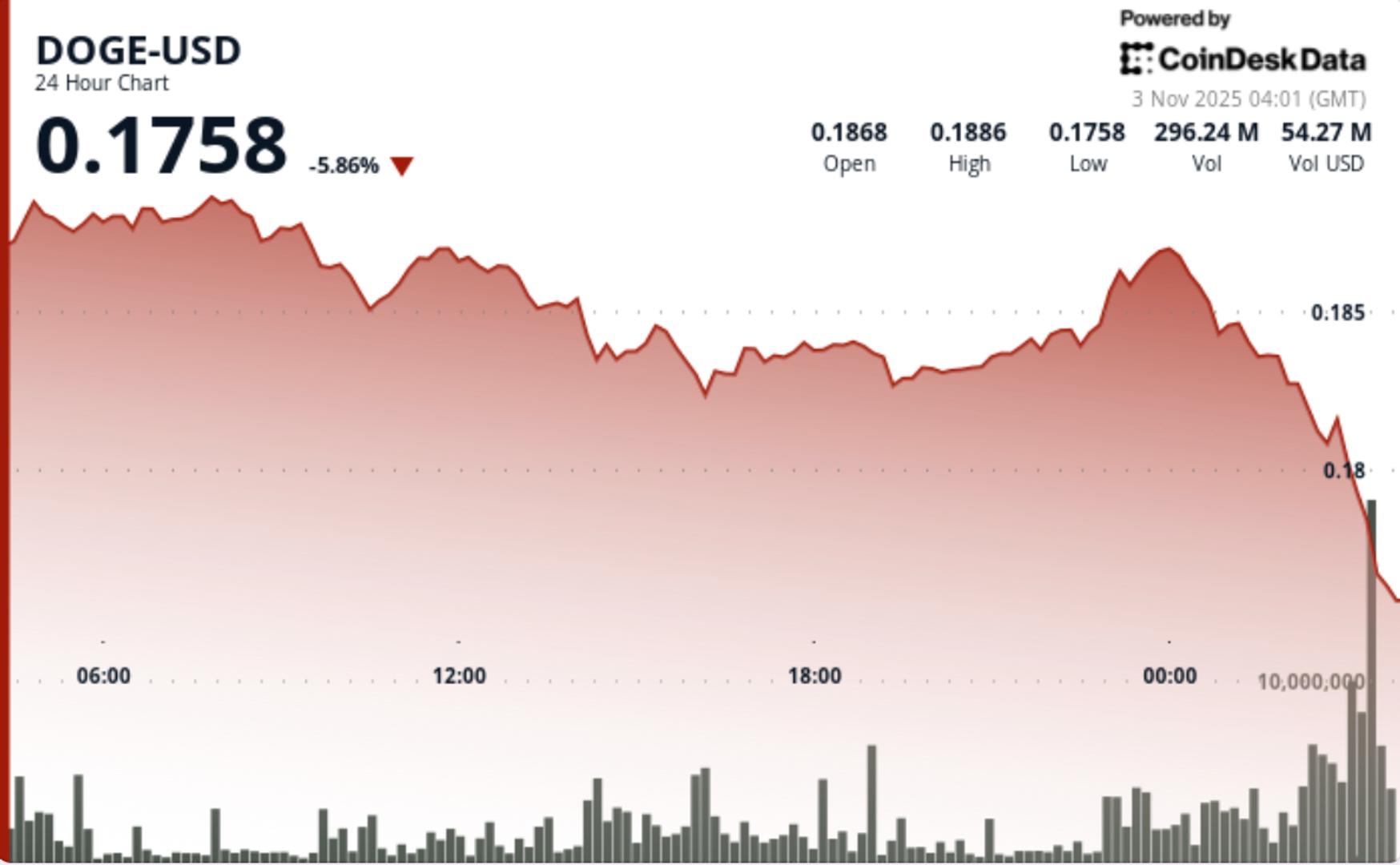

DOGE Falls to $0.18 as Long-Term Holders Exit, 'Death Cross' Price Action Appears

The Best Crypto Presale in 2025? Solana and ADA Struggle, but Lyno AI Surges With Growing Momentum