Is Ripple’s (XRP) Price About to Explode to $22 this Bull Run?

Ripple (XRP) is trading near $3, around 18% below its all-time high of $3.65. After reaching a recent peak of $3.07, the price pulled back slightly but remains stable. The trading volume over the last 24 hours is approximately $4.92 billion. While price action was negative in the short term, XRP has gained 5% in the past week.

Analysts are watching key levels and patterns that could shape the next move.

Resistance Forms Near $3.07

The early push to $3.07 saw significant selling activity. This area now acts as short-term resistance. Volume increased sharply at that level, suggesting strong profit-taking. XRP then dropped back to $3.00, where buyers have stepped in. The $2.98 level has been tested multiple times and continues to hold.

CRYPTOWZRD noted that a move above $3.01 would open the way to $3.13, with $3.15 being the next area to watch. He added,

Until then, traders remain focused on short-term price setups.

Price Pattern Suggests Breakout Phase

A longer-term view shows a repeating four-phase structure. XRP has followed a similar path in the past: a strong rally, long correction, tight consolidation, then breakout. Based on current price behavior, XRP appears to be in the final phase again.

Analyst CW pointed out that only an 18% move is needed to retest the previous high. The same setup appeared before XRP’s major run in 2017. If momentum builds above $3.30, historical price targets suggest $22 could come into view. This is based on Fibonacci levels often used by technical traders.

On the XRP/BTC chart, price is compressing inside a symmetrical triangle that started forming in 2018. The chart now shows price near the upper boundary of that pattern. A breakout from this zone could shift momentum in XRP’s favor.

CW stated:

Remarkably, the last time this pair broke from a similar setup, XRP outperformed Bitcoin for several months. Traders are now watching volume closely for signs of follow-through.

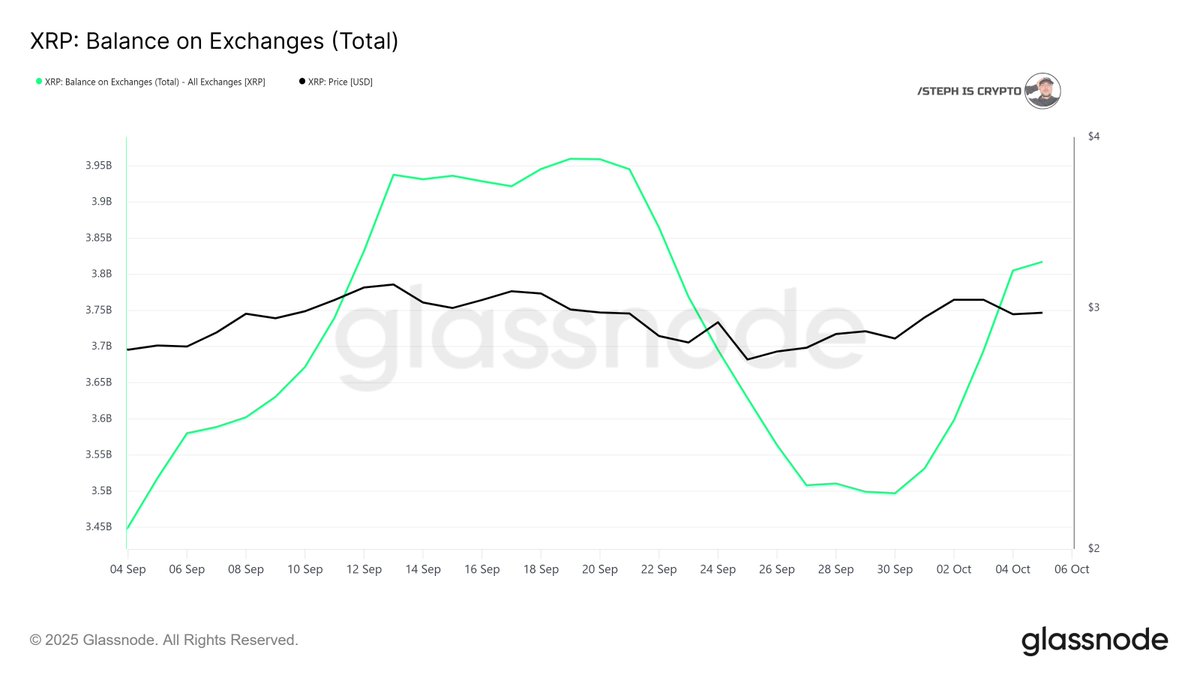

Exchange Inflows Raise Questions

Data from Glassnode confirms that more than 320 million XRP — worth about $950 million — were moved to exchanges between September 26 and October 5. Balances on exchanges rose from 3.45 billion to 3.85 billion XRP in that time.

-

Source: Steph Is Crypto/X

Source: Steph Is Crypto/X

Despite this increase, XRP’s price remained stable. This suggests the market either absorbed the added supply or the tokens have yet to be sold. Analyst Steph Is Crypto posted,

Large inflows to exchanges are often viewed as a signal that selling may follow. Whether this happens will depend on how price and volume behave in the days ahead.

The post Is Ripple’s (XRP) Price About to Explode to $22 this Bull Run? appeared first on CryptoPotato.

You May Also Like

US Federal Reserve leads central banks across the world into rate easing period

Grayscale debuts first Ethereum and Solana ETFs offering staking rewards