MAGACOIN FINANCE Forecasts 10,000% ROI — Ethereum and Cardano Whales Join Early Presale Round

The last few weeks saw MAGACOIN FINANCE emerge as one of the most prospective early stage projects in the cryptocurrency field. The presale is yet to be completed, but Ethereum and Cardano whales have already shown interest in it, and now, they are preparing to get massive profit. Analysts project that it can grow up to 10,000% on MAGACOIN FINANCE becoming the ideal target of a retail investor or an institutional investor.

Ethereum Price Decline and Market Sentiment

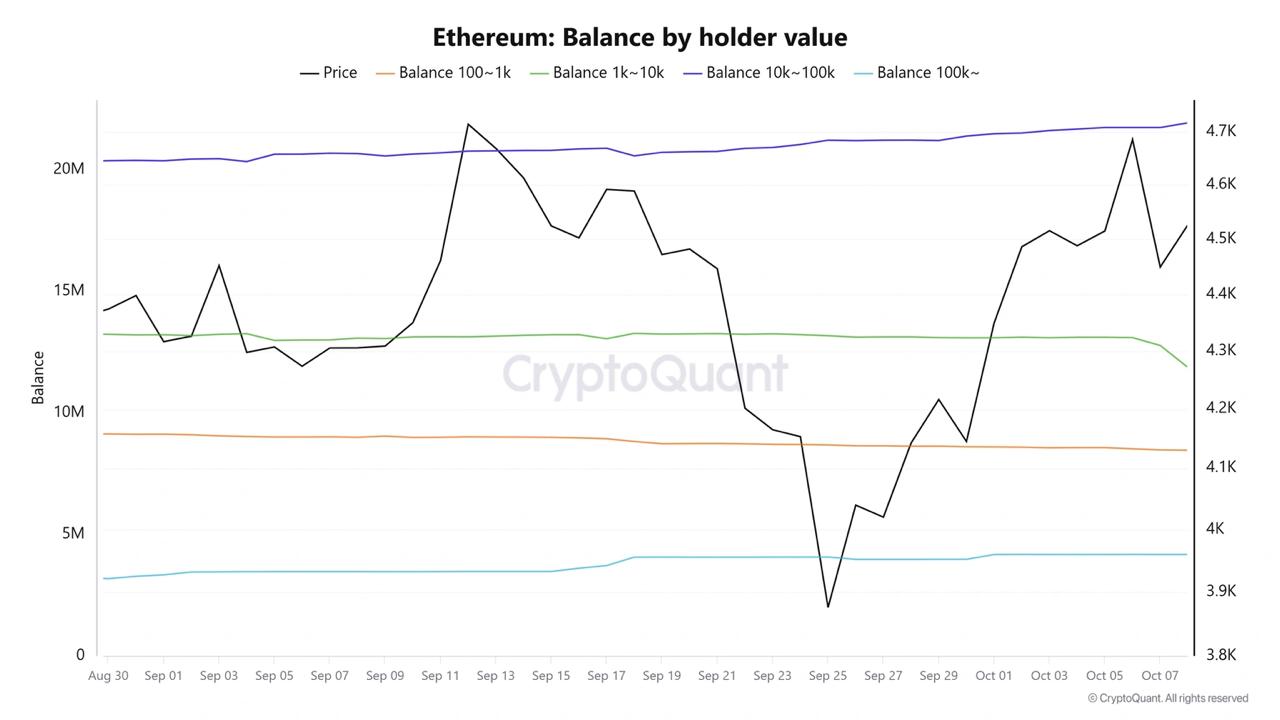

By Friday, Ethereum (ETH) had fallen by about 4%. This is following the sale of 1.22 million ETH by medium-scale holders, and it has led to significant price drops over the past few days. At some point of the week ETH had hit its peak of approximately $4,700, but in the process, it was rejected, and dropped to approximately $4,300.

This market response indicates that the market is prone to the activities of the profit-taking by the medium-sized traders, or wallets with 1K-10K ETH. According to the information presented by CryptoQuant, these holders have sold a large fraction of ETH since Monday, which adversely impacted the price. Whale wallets (10K-100K ETH) have however, grabbed this chance and expanded positions by 200K ETH which could be a sign of an active accumulation phase.

ETH Balance by Holder Value. Source: CryptoQuant

The Ethereum fundamentals remain vibrant despite the price backlash with the increase in staking as a result of the latest moves by Grayscale. The company made a bet of over 850,000 ETH, on its Ethereum ETF, which created more scarcity in the market. The institutional interest in ETH however is seen to be waning, as fewer funds are being deposited in Ethereum-based ETFs.

Cardano Faces Profit-Taking and Bearish Sentiment

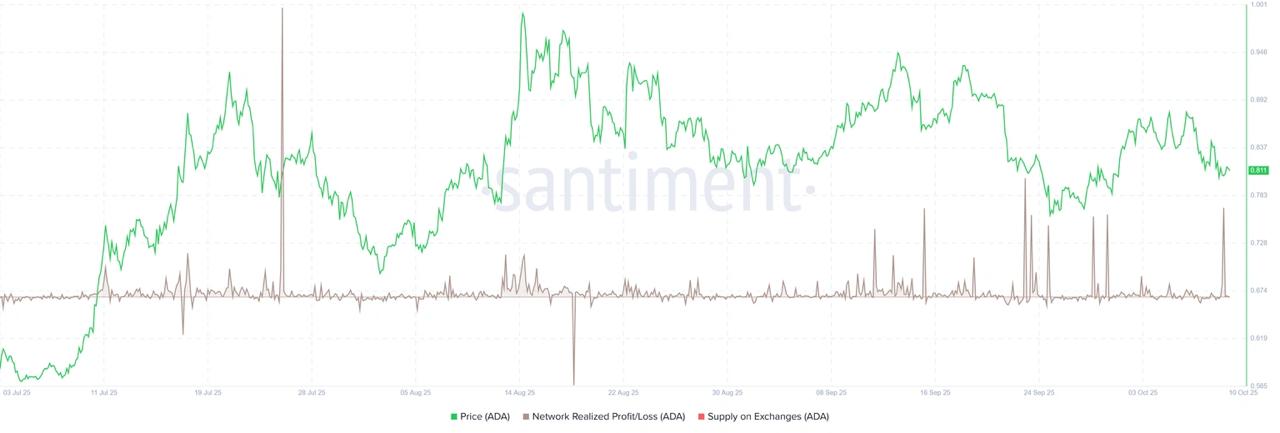

Cardano (ADA) declined by a comparable margin, having fallen by 3% this week. On-chain and derivatives data suggest that the profit-taking among the holders of ADA is rising, which further escalates its correction. ADA holders are cashing out at profit, which is reflected in the Santiment Network Realized Profit/Loss metric and placing pressure on the sell side.

ADA chart. Source: Santiment

The long to short ratio of ADA is bearish because it has hit a high within over a month. As more traders establish themselves to fall, it indicates a further loss of momentum of ADA unless more buyers enter the market. The technical outlook of Cardano is the negative one because the market indicators indicate that it is capable of experiencing the weakening trend.

These may be the short-term difficulties but the long-term future of the Cardano could be bright, according to the market and project technological improvement. However, the present performance of ADA is a concern to be concerned about in the short term.

MAGACOIN FINANCE Gains Whale Attention

With Ethereum and Cardano failing to maintain their pace to market pressure, MAGACOIN FINANCE is becoming a growing trend amongst whales in both the ecosystems. There are big investors and shareholders of Ethereum and Cardano who are investing their money in MAGACOIN FINANCE and are likely to receive much.

MAGACOIN FINANCE presale has been gaining traction and the project is successful owing to its fixed supply of tokens. The scarcity based business model has attracted high-level investors who are of the opinion that the project has an upside potential of 10000%. As noted by analysts, MAGACOIN FINance has deflationary tokenomics and a community engagement which makes the company one of the best crypto to buy now.

Other important characteristics of attractiveness of MAGACOIN FINANCE are security and transparency. The project itself is audited at length by HashEx that validates its smart contracts as safe and effective. This audit has also moved the investor confidence in MAGACOIN FINANCE to the safe investment choice of the retail and institutional investors.

Conclusion: Best Altcoin to Buy

The current situation with Ethereum and Cardano has rendered the right moment to allow investors to venture into uncharted horizons. Nevertheless, both ETH and ADA are good projects despite these short-term corrective measures. MAGACOIN FINANCE however has a strong case with 10,000% ROI in presale and its good whale support. MAGACOIN FINANCE is one of the top altcoins to purchase at the current time, in case one aims at obtaining high potential returns.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post MAGACOIN FINANCE Forecasts 10,000% ROI — Ethereum and Cardano Whales Join Early Presale Round appeared first on Coindoo.

You May Also Like

Bitcoin Price Crashes 9% Amid Historic $19B Liquidation, What’s Next?

Why the Crypto Market Is Crashing Today?