Posco Bets on Europe’s EV Boom, Launches Motor Core Facility

TLDRs;

- Posco International opened a $67M EV motor core plant in Brzeg, Poland, to meet Europe’s surging EV demand.

- The facility will produce 1.2 million motor cores annually, beginning full-scale production in December 2025.

- The expansion strengthens Posco’s three-continent EV supply chain as it targets a 10% global market share by 2030.

- The move aligns with Europe’s 2035 gas car ban and positions Posco amid intensifying EV competition led by BYD and Tesla.

Posco International, a key trading and manufacturing arm of South Korea’s Posco Group, has launched a new electric vehicle (EV) motor core plant in Brzeg, Poland, reinforcing its presence in the rapidly growing European EV market.

The $67.1 million (₩94.1 billion) facility spans 100,000 square meters and represents one of Posco’s most ambitious European investments yet. The plant, which held its official completion ceremony earlier this week, will begin pilot production in October and move to full-scale manufacturing in December, with an annual output capacity of 1.2 million motor cores.

CEO Lee Kye-in attended the opening ceremony alongside Opole province governor Monika Jurek, emphasizing the plant’s strategic role in positioning Posco as a leader in Europe’s EV component supply chain.

Part of a “Three-Continent” EV Supply Chain

The Poland plant adds a critical piece to Posco International’s “three-continent production belt,” joining existing operations in South Korea, Mexico, and India.

With facilities in Pohang and Cheonan already producing 2.5 million motor cores annually, Mexico contributing 3.5 million, and India adding 300,000, the company aims to achieve a global production capacity of 7.5 million units by 2030.

This global reach is part of Posco’s broader ambition to capture 10% of the worldwide EV motor core market by the end of the decade. The company projects its motor core sales will triple from ₩450 billion ($320 million) in 2025 to ₩1.5 trillion ($1.06 billion) by 2030.

Europe Emerges as EV Battleground

Posco’s expansion into Europe comes amid intensifying competition between global EV makers. The continent is emerging as a key battleground between Chinese automaker BYD and U.S. giant Tesla, according to data from JATO Dynamics.

BYD’s European sales surged 359% year-over-year in April, overtaking Tesla’s volumes for the first time , a “watershed moment” for Europe’s EV industry, analysts said.

Despite the EU’s punitive tariffs on China-made electric vehicles, as high as 35% for some models, BYD continues to gain market share by localizing production and diversifying its lineup. The firm’s dominance underscores Europe’s growing appetite for affordable EVs, even as Tesla faces setbacks, including regional protests and falling sales.

Against this backdrop, Posco International’s Poland facility positions the Korean firm to become a reliable local supplier of critical EV components, reducing Europe’s dependence on imports from China and bolstering the continent’s efforts to secure a sustainable electric mobility ecosystem.

Aligning with Europe’s 2035 Gas Car Ban

The new plant also aligns with the European Union’s planned 2035 ban on the sale of new internal combustion engine vehicles, a policy driving unprecedented investment in EV manufacturing infrastructure.

Automakers across the region are racing to localize their supply chains to comply with the new environmental regulations and meet surging consumer demand for electric alternatives.

As the global EV market becomes more competitive, Posco’s timing couldn’t be better. With Europe’s electric car registrations up by nearly 30% year-over-year, the region offers immense growth potential for suppliers capable of delivering high-performance, cost-efficient components at scale.

The post Posco Bets on Europe’s EV Boom, Launches Motor Core Facility appeared first on CoinCentral.

You May Also Like

Pi Network News: Major Development Announced as Project Enters New Phase

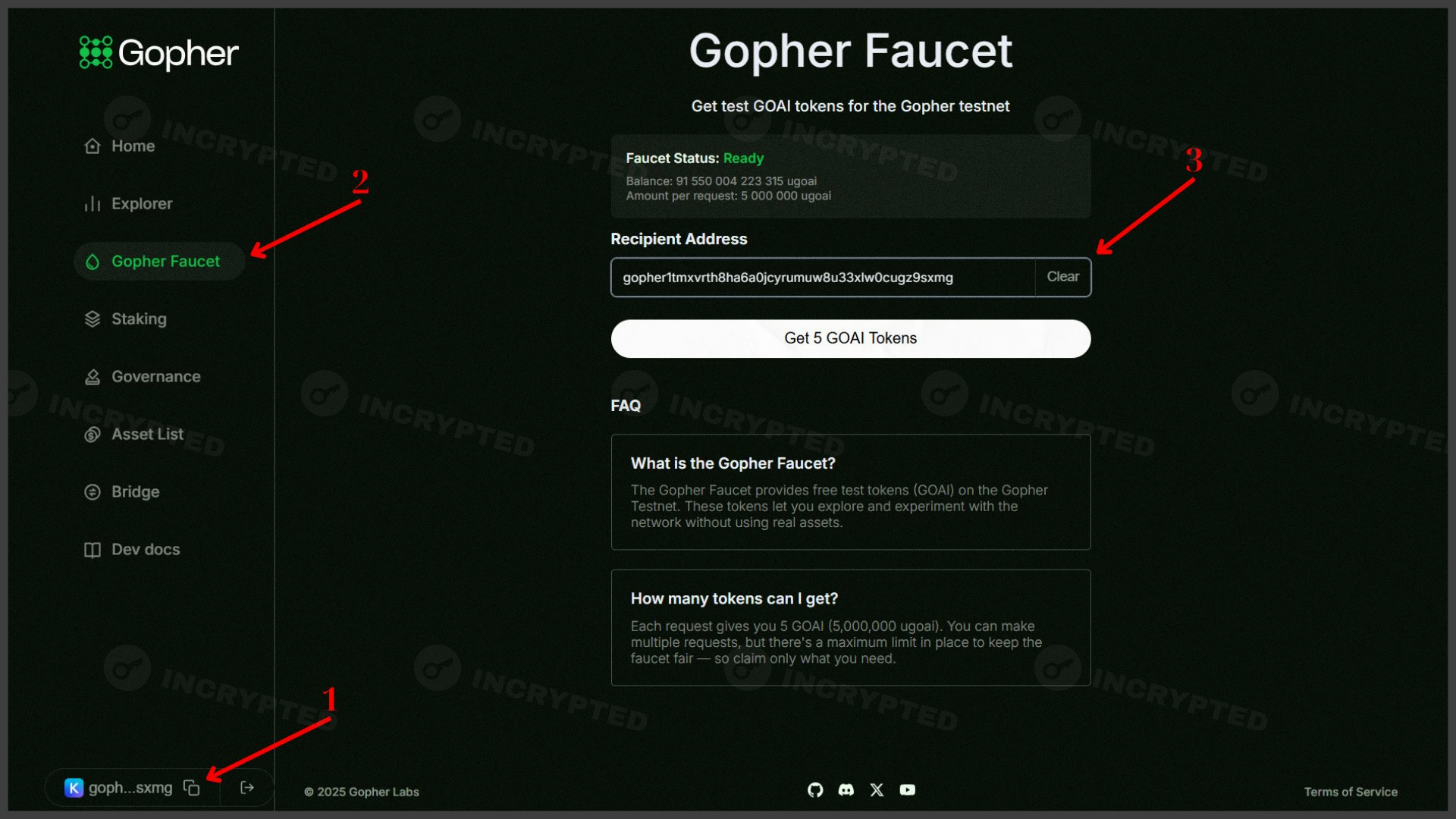

Gopher — active participation in the testnet with the aim of airdrop