SWIFT and Ripple Collaboration: Rumors of a Pilot Tested for Accuracy

TLDR

- SWIFT has outlined plans to experiment with distributed ledger technology in its 2025 roadmap.

- There is no official statement confirming Ripple’s involvement in SWIFT’s digital asset trials.

- Ripple has consistently emphasized its independence from traditional banking systems like SWIFT.

- Industry reports suggest SWIFT’s internal tests may include the XRP Ledger, but these claims are unverified.

- A formal SWIFT and Ripple partnership would mark a significant shift in Ripple’s long-term strategy.

Rumors of a potential collaboration between SWIFT and Ripple have sparked intense interest in the crypto community. A recent tweet by Yuto, a prominent figure in the XRP community, suggested that SWIFT is preparing to announce a formal pilot with Ripple. This has led to widespread speculation about the future of cross-border payments. However, it is important to scrutinize the facts before jumping to conclusions.

No Confirmation of Ripple in SWIFT Pilots

SWIFT, a leading global payments network, serves over 11,000 financial institutions worldwide. It has outlined plans to experiment with distributed ledger technology (DLT) in its 2025 roadmap. The company aims to test live experiments for tokenized asset transfers across borders.

Despite these plans, there is no official statement confirming Ripple’s involvement. SWIFT’s documents highlight general DLT trials but do not specifically mention Ripple or the XRP Ledger. Although rumors suggest that SWIFT may be experimenting with the XRP Ledger, no formal confirmation has been made.

Some industry reports claim that SWIFT’s internal tests include the XRP Ledger along with other technologies like Hedera Hashgraph. These reports rely on unnamed sources, and they have not been verified through official press releases. As a result, there is no definitive proof that Ripple is directly participating in any SWIFT pilot.

XRP Community Urges Ripple to Stay Independent

Ripple has long emphasized its independence from traditional banking systems. In 2025, Ripple reaffirmed its goal of offering an alternative liquidity rail, separate from legacy systems like SWIFT. Ripple aims to create a more decentralized and efficient cross-border payment system, which does not rely on traditional networks.

A formal partnership with SWIFT would mark a significant shift in Ripple’s strategy. However, company representatives have not suggested any such move. While SWIFT explores DLT solutions, Ripple remains focused on its mission to provide alternatives to existing financial systems.

Many voices in the XRP community, including Yuto, have suggested that Ripple should maintain its autonomy. These opinions reflect concerns that joining forces with SWIFT might hinder Ripple’s growth and long-term goals. As the debate continues, it is clear that any potential collaboration would require careful consideration.

No Official Announcement from SWIFT

Despite the speculation, SWIFT has not made any official announcements regarding a partnership with Ripple. The company’s recent efforts in DLT experimentation do not specifically highlight Ripple as a key player. Until verified by official sources, the claims of a formal SWIFT–Ripple pilot remain speculative.

The excitement surrounding this potential collaboration is understandable, given the importance of both entities in the payments space. However, without solid evidence, it is premature to treat these rumors as facts.

The post SWIFT and Ripple Collaboration: Rumors of a Pilot Tested for Accuracy appeared first on CoinCentral.

You May Also Like

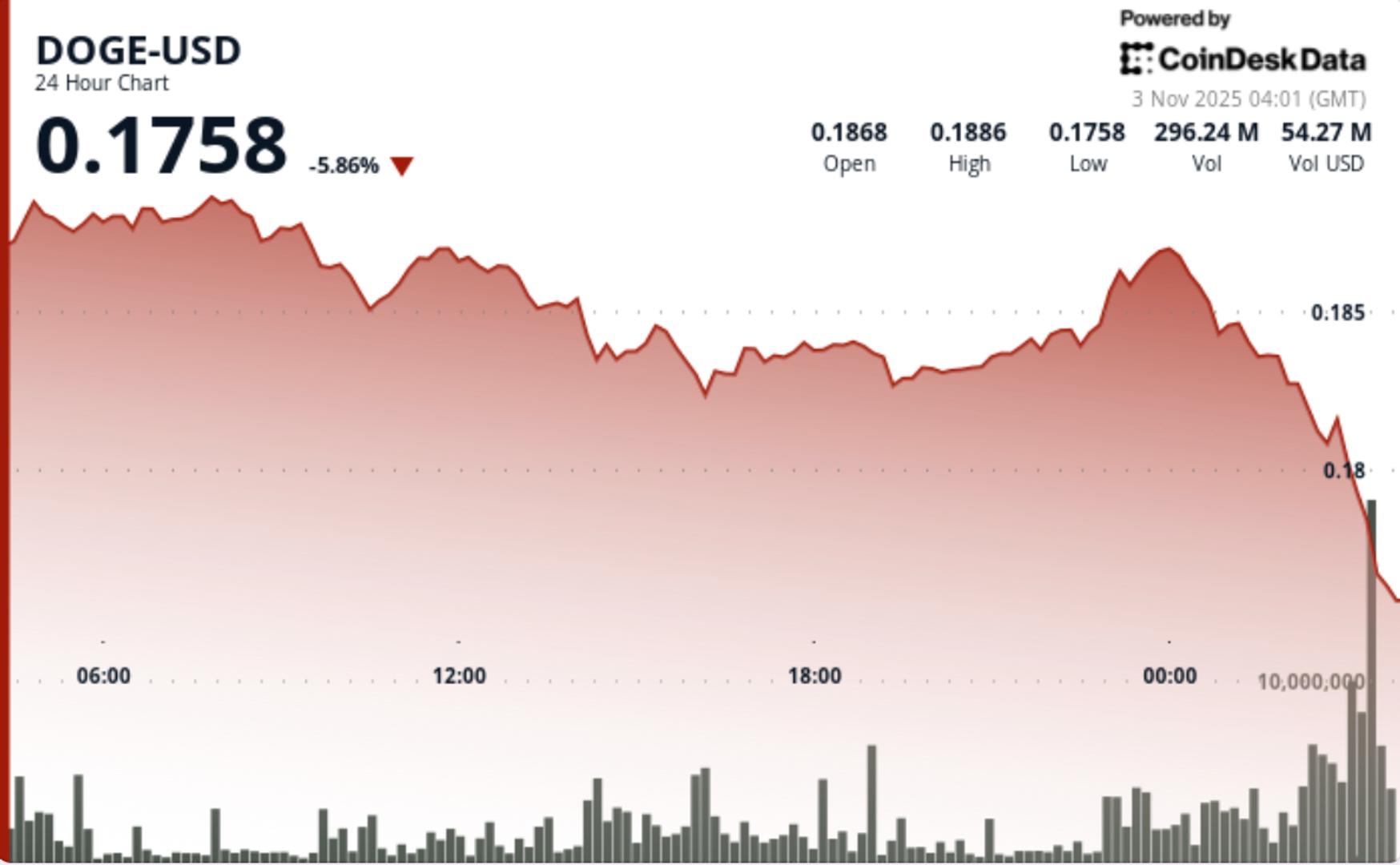

DOGE Falls to $0.18 as Long-Term Holders Exit, 'Death Cross' Price Action Appears

CME Group to Launch Solana and XRP Futures Options