Top 3 Best Crypto With 500% Growth Potential in 2026, Analysts Weigh In

Analysts are closely watching the next big bull cycle in 2026. Bitcoin has been consolidating, and investors are looking for altcoins with real use cases that will outperform hype tokens. Mutuum Finance (MUTM), Solana (SOL), and Cardano (ADA) have attracted significant attention. Each token represents a different type of growth engine. Mutuum Finance (MUTM) focuses on DeFi innovation. Solana (SOL) provides high-speed blockchain scalability. Cardano (ADA) delivers academic precision and structured governance. Analysts estimate these three projects will deliver up to 500% growth over the next cycle.

Solana (SOL) — The High-Speed Ecosystem

Solana (SOL) continues to enhance transaction stability and increase developer activity. Institutional partnerships add credibility and adoption. Analysts predict SOL will rise to $300–$350 by 2026, providing a 3–4× growth. Solana is a reliable play for scalability and large-scale projects, though its upside is more limited than early-stage opportunities like Mutuum Finance (MUTM)

Cardano (ADA) — Academic Precision and Governance

Cardano (ADA) focuses on academic-style development and governance. Its Hydra scaling solution, smart contract tools, and sustainability framework attract long-term investors. Analysts anticipate ADA reaching $2.50–$3.00 by 2026, about 5–6× growth from today. Cardano offers steady gains but moves more slowly than high-velocity platforms.

Presale Snapshot — Mutuum Finance (MUTM) Steals the Spotlight

Mutuum Finance (MUTM) will introduce a next-generation decentralized lending and borrowing protocol. It will operate two coexisting models. P2C, or Peer-to-Contract, allows borrowers to interact directly with liquidity pools. This model offers fast and predictable loans using popular assets like ETH or USDT. P2P, or Peer-to-Peer, enables direct user-negotiated loans for riskier tokens such as DOGE, PEPE, and SHIB. This dual approach attracts both institutional and retail liquidity while creating flexibility for different types of users.

Mutuum Finance (MUTM) is currently in Phase 6 of its presale.

The total supply of MUTM will reach 4B tokens. So far, approximately $18.35 million has been raised. Phase 6 has allocated 170 million tokens, with 85% already sold. The current price stands at $0.035, and Phase 7 will see a 15% increase to $0.040. Over 17,750 investors have joined, showing strong market interest.With Phase 6 nearly sold out and Phase 7 approaching, investors are racing to secure MUTM. Purchases are now available by card with no limits, making entry simple for retail investors worldwide. The presale presents a rare early opportunity before the token’s simultaneous launch and exchange listing.

Growth Drivers Behind the 500% Projection

Mutuum Finance (MUTM) plans to launch its lending platform while simultaneously listing the token on exchanges. This synchronized rollout is a strong growth catalyst. Investors will gain immediate access to borrowing, staking, and mtToken issuance. Active modules on launch day will generate organic trading volume, attracting the attention of Tier-1 and Tier-2 exchanges. Early utility ensures that MUTM begins its trading journey with real network activity, user fees, and liquidity.

The platform will deliver real utility through ongoing DeFi operations. Q4 2025 will see the V1 of the protocol on Sepolia Testnet, including liquidity pools, mtToken mechanics, Debt Tokens, and automated Liquidator Bots. At this stage, users will be able to lend, borrow, and use ETH or USDT as collateral with a straightforward and seamless experience. These features create constant transactional demand.

$1 Pegged Stablecoin and Open Market Buybacks of MUTM

A decentralized $1-pegged stablecoin will allow users to mint by locking approved assets like ETH, SOL, and AVAX. Each mint or burn increases MUTM interactions, expanding its role across lending, staking, and fee collection. This ecosystem design ensures MUTM becomes essential for daily operations, driving consistent demand.

Revenue from borrowing fees and yield differences will fuel Mutuum’s buy-and-distribute system. Platform earnings will purchase MUTM from open markets and distribute tokens to mtToken stakers. More users generate more fees, which leads to more buybacks and strengthens value. This revenue-based cycle supports long-term growth and incentivizes holders with direct rewards.

An investor who purchased $5,000 of MUTM during Phase 2 at $0.015 now holds 333K MUTM, valued around $12K at the current $0.035 price — already a 133% gain before listing. Analysts project that by 2026, MUTM’s price will range from $0.175 to $0.20. That translates into a portfolio value of $58,000 to $66,000, offering more than 1,100% ROI.

Conclusion — Three Paths to Growth, One Standout

Solana (SOL) and Cardano (ADA) provide reliable ecosystems, but Mutuum Finance (MUTM) offers the highest early-stage multiple. Its dual lending model, real utility, and dividend-driven economy position it for significant growth. Mutuum also runs a $100,000 community giveaway with ten winners receiving $10,000 each in MUTM tokens.

Phase 6 is 85% sold out, and Phase 7 will see a 15% price rise to $0.040. With card purchases open, this is the final discounted window before Mutuum Finance (MUTM) launches and lists, activating its DeFi engine and driving momentum. Investors seeking the best crypto to invest will want to secure MUTM during this exclusive presale. Opportunities like this could attract attention from crypto ETF portfolios looking for high-growth assets.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

You May Also Like

Why New and Young Investors See Ozak AI as Their Best Shot at Becoming Crypto Millionaires

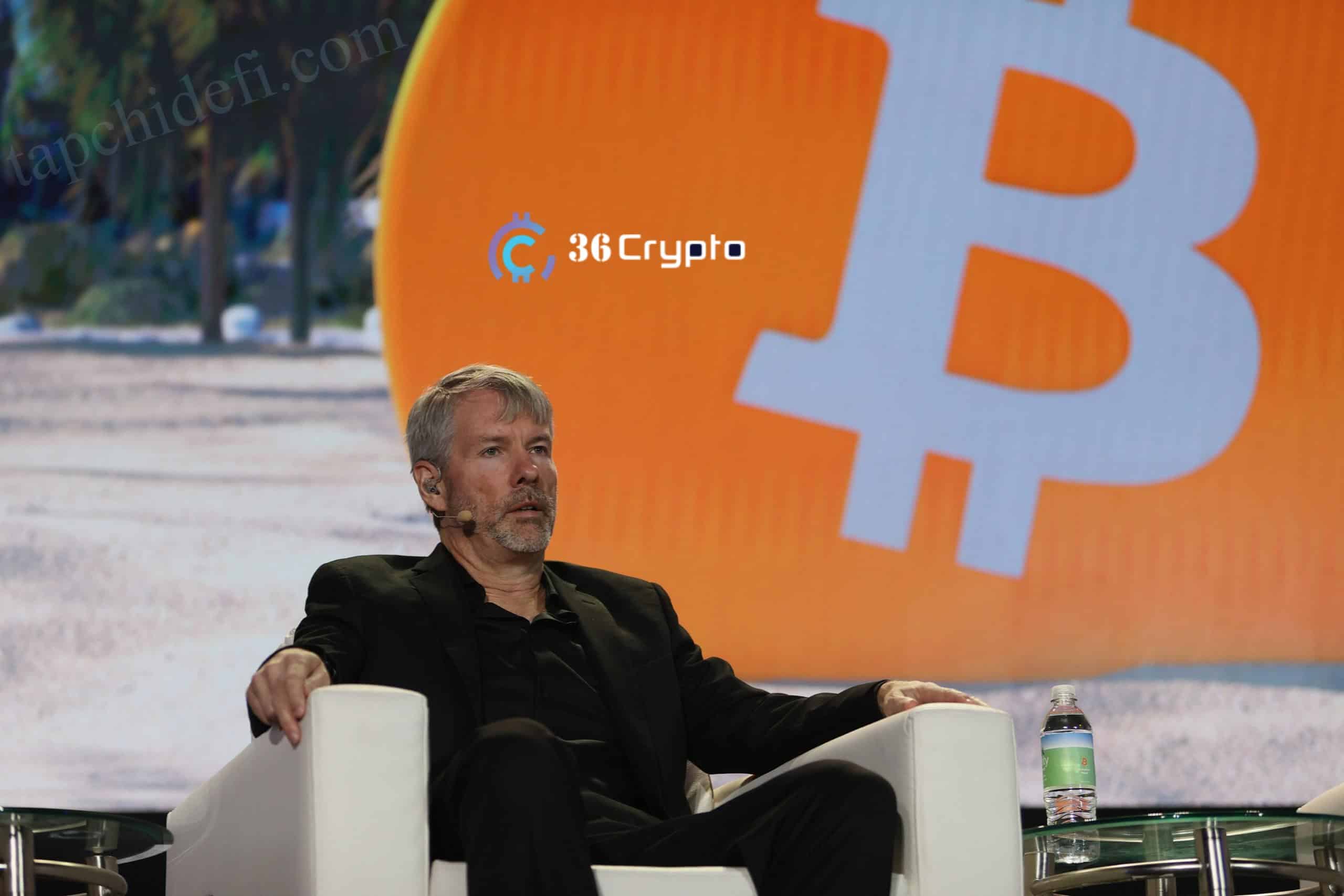

Michael Saylor: My only worry for Halloween this year is not having enough Bitcoin.