Wolfspeed (WOLF) Stock: Jumps 34% as Chipmaker Exits Bankruptcy and Slashes Debt

TLDRs;

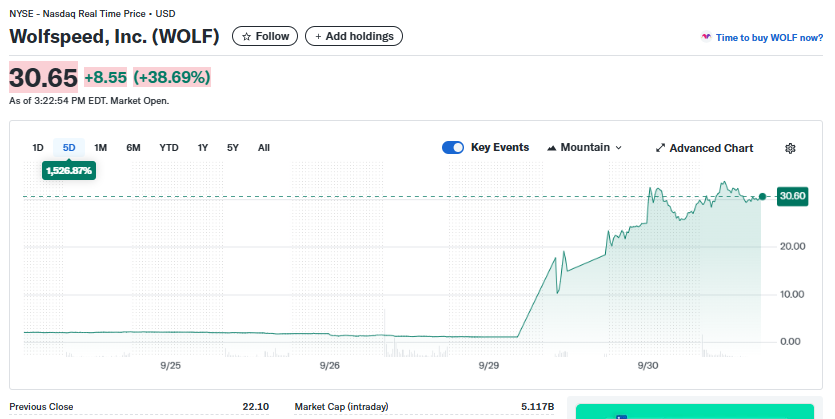

- Wolfspeed stock surged 34% Tuesday after the chipmaker emerged from Chapter 11 bankruptcy with a 70% debt cut.

- The company reduced annual cash interest expenses by 60%, freeing up liquidity for growth in EV and energy markets.

- Leadership changes include a new CFO and five new directors, signaling a governance reset for long-term stability.

- Legacy shareholders were heavily diluted, holding less than 1% ownership after restructuring, while creditors gained equity stakes.

Shares of Wolfspeed, Inc. (NYSE: WOLF) soared 34% on Tuesday, trading at $29.63 by mid-afternoon in New York, after the chipmaker confirmed it had successfully emerged from Chapter 11 bankruptcy.

The company, best known for producing silicon carbide (SiC) semiconductors used in electric vehicles (EVs), solar inverters, and industrial power systems, announced that it cut its overall debt load by nearly 70% while lowering annual cash interest expenses by about 60%.

The restructuring marks a major turning point for Wolfspeed, which filed for bankruptcy protection in June due to economic uncertainty, weakening demand, and shifting U.S. trade policies. Tuesday’s rally reflected investor relief that the firm not only stabilized but also positioned itself for renewed growth.

Wolfspeed, Inc. (WOLF)

Wolfspeed, Inc. (WOLF)

Leadership Overhaul and Fresh Liquidity

As part of its restructuring, Wolfspeed reshaped its leadership and governance structure. The company appointed five new directors to its board, including industry veterans such as former Micron executive Mike Bokan and outgoing Corning president Eric Musser.

Additionally, Wolfspeed named Van Issum as its new CFO, a move analysts say signals a fresh financial discipline aimed at guiding the company through its recovery phase.

According to CEO Robert Feurle, Wolfspeed is now well-positioned to tap into rising demand for silicon carbide in rapidly growing markets such as EVs, AI computing, industrial equipment, and clean energy solutions.

Impact on Shareholders and Market Standing

While Wolfspeed’s new financial footing is a positive for creditors and backstop investors, legacy shareholders absorbed a heavy blow. The company canceled all old equity shares as part of the bankruptcy process, issuing only 1.3 million new shares at a steep conversion rate that left original shareholders with less than 1% ownership.

This move dilutes prior equity holders significantly but ensures Wolfspeed retains a stronger capital structure. Analysts warn, however, that Wolfspeed continues to operate at a loss and currently trades with a negative earnings multiple, lagging behind peers such as Onsemi (P/E 17.9) and NXP Semiconductors (P/E 16.7).

Despite this, the market’s reaction indicates confidence that Wolfspeed’s debt relief and strategic reset will improve its long-term prospects in the EV and semiconductor sectors.

Positioning for the EV and Energy Future

The resurgence of Wolfspeed comes at a critical time when automakers are increasing chip content per vehicle to meet growing electrification needs.

Silicon carbide chips are prized for their efficiency, enabling longer battery life and better energy performance in EVs. With demand expected to grow rapidly, Wolfspeed’s leaner balance sheet gives it the breathing room to expand production and secure supply deals.

Industry observers suggest Wolfspeed could become a pivotal player in the global push for decarbonization, particularly as governments incentivize EV adoption and renewable energy infrastructure. The challenge, however, remains whether the company can translate its stronger balance sheet into sustained profitability.

The post Wolfspeed (WOLF) Stock: Jumps 34% as Chipmaker Exits Bankruptcy and Slashes Debt appeared first on CoinCentral.

You May Also Like

Taiko Makes Chainlink Data Streams Its Official Oracle

BitGo receives approval from Germany’s BaFIN to offer regulated cryptocurrency trading in Europe