XRP Rises 3% on SBI Lending Boost and ETF Momentum

According to recent market updates, XRP ETF approval is once again stealing the spotlight. Ripple’s token has climbed to $3.04, holding steady above the $3 line after a burst of institutional buying.

SBI Holdings’ expansion of XRP lending in Japan and the looming SEC ETF deadline are now the twin engines driving speculation. Traders want to know if this setup can carry XRP beyond its resistance levels.

Institutional Lending Gives XRP A Boost

SBI Holdings’ announcement that it will broaden its institutional XRP lending services is a significant step. In Japan, this type of corporate involvement signals a deeper adoption and a willingness from major players to embrace digital assets.

Analysts in Asia note that such lending programs enhance liquidity and boost confidence in markets that previously relied heavily on retail flows. As one market report noted, institutional lending “adds a new floor for XRP’s credibility.”

Also Read: XRP ETF Approval Odds Surge as Experts Warn of Underestimated Demand

The Countdown To ETF Verdicts

The storm is in the U.S., where XRP ETF approval faces review. Seven applications await SEC rulings on October 18, a date seen as a make-or-break moment. Prediction markets yield approval odds above 99%, demonstrating exceptional confidence.

XRP ETF news highlights that even a single approval could unleash fresh capital, with analysts noting that ETFs “open the door for retirement accounts and institutions that can’t hold tokens directly.”

Price Action: Holding The Line

Over the last 24 hours, XRP has traded within a narrow corridor between $2.95 and $3.10, with the current quote at $3.04. An intense burst of 212 million tokens exchanged hands during a late rally, more than double the daily average. That surge pushed XRP to test $3.10, but resistance held firm.

For now, the token is consolidating between $3.00 and $3.05, a sign that accumulation is underway. Support has been defended repeatedly at $2.99. Traders are waiting for a clean close above $3.10, which could signal the start of the next leg toward $3.20. Without XRP ETF approval, that breakout may stall.

Source: Coinmarketcap

Source: Coinmarketcap

Technical Signals In Focus

Support sits at $2.99 while resistance hardens at $3.10. The band of consolidation above $3 is encouraging, suggesting professional buyers are preparing for the next move. Volume spikes validate institutional interest, but conviction still hinges on a breakout.

With XRP ETF news dominating headlines, technical traders keep their eyes glued to October’s calendar.

What Traders Are Watching

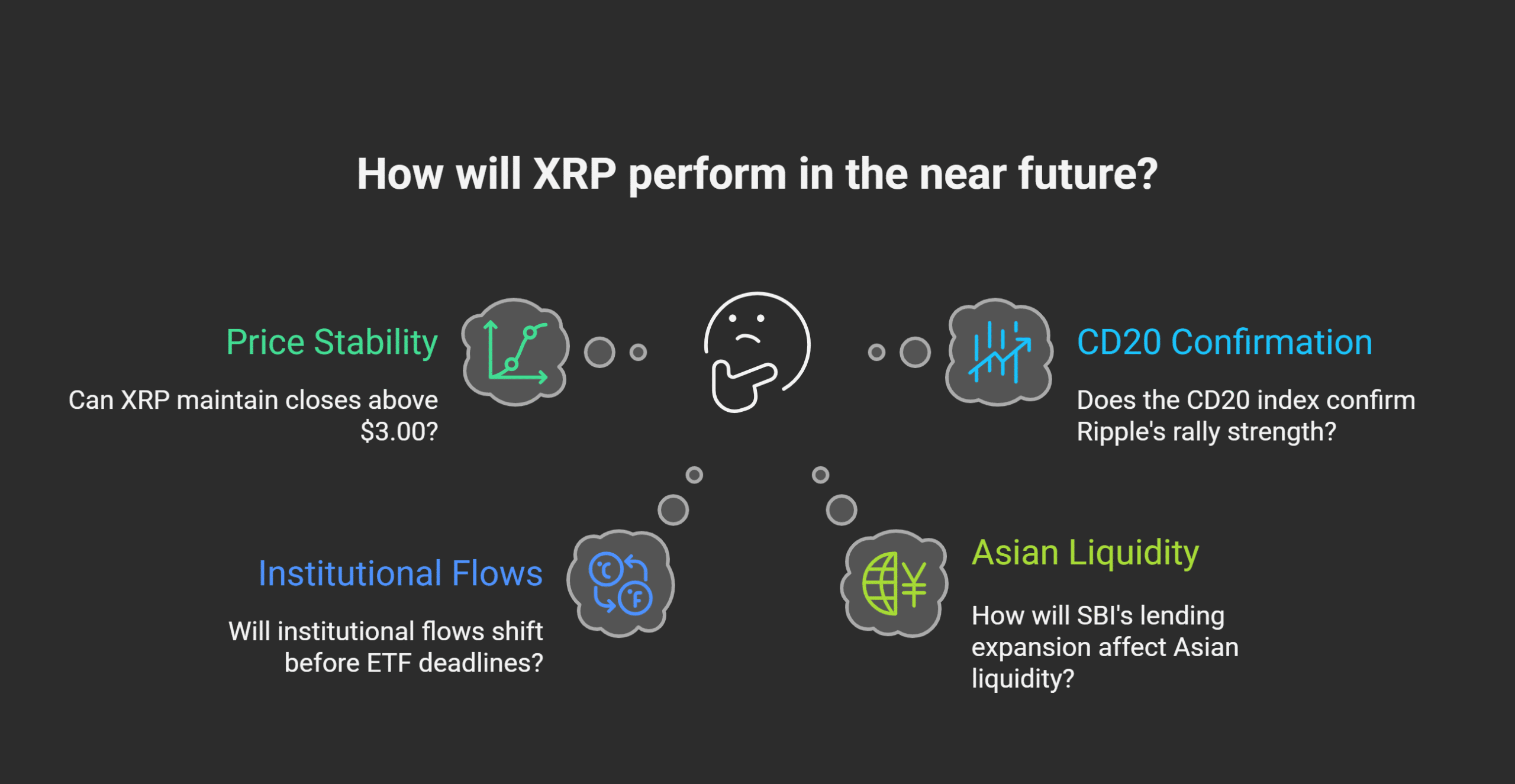

- Can XRP hold steady closes above $3.00?

- Will institutional flows shift ahead of the SEC’s ETF deadlines?

- How will SBI’s lending expansion affect Asian liquidity?

- Does the CD20 index confirm the strength led by Ripple’s rally?

Conclusion

Based on the latest research, XRP ETF approval could spark a shift in Ripple’s outlook. SBI’s lending adds fuel, while ETF anticipation builds pressure.

XRP now stands at a crossroads. Traders often “buy the rumor and sell the news,” but this rumor carries weight. October 18 may determine whether XRP breaks resistance and marks the beginning of a new chapter in its long journey.

Read More: XRP ETF Approval Could Be Weeks Away: Analysts Eye Fall 2025

Summary

XRP trades near $3.04, holding above $3 with support at $2.99 and resistance at $3.10. The rally is driven by SBI Holdings’ expansion of institutional lending in Japan and the countdown to SEC decisions on seven ETF applications, due on October 18.

With markets pricing XRP ETF approval odds above 99%, traders see October as a turning point. The outcome could unlock new flows and reshape Ripple’s long-term path.

Glossary of Key Terms

- ETF: Exchange-Traded Fund, a regulated product that tracks assets.

- Liquidity: The ability to buy or sell an asset quickly without sharp moves.

- Support/Resistance: Price levels where buyers or sellers usually step in.

- Market Consolidation: A period when prices trade within a narrow range, showing a balance between buyers and sellers before the next big move.

FAQs About XRP ETF Approval

Q: When is the SEC’s first decision on XRP ETFs?

A: October 18, 2025.

Q: Why is SBI’s role important?

A: Its lending expansion in Japan adds credibility and liquidity for XRP.

Q: What price range is XRP trading in now?

A: Between $2.95 and $3.10, with resistance at $3.10 and support near $2.99.

Q: How can ETF approval change things?

A: It could bring new inflows from funds and accounts restricted to regulated products.

Read More: XRP Rises 3% on SBI Lending Boost and ETF Momentum">XRP Rises 3% on SBI Lending Boost and ETF Momentum

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Cashing In On University Patents Means Giving Up On Our Innovation Future