dYdX Launches Its First Solana Spot Trading Product in US: Will Solana Price Surge?

Dousing the bearish sentiment, dYdX, one of the largest decentralized exchanges, made a major announcement that could further expand Solana SOL $137.2 24h volatility: 0.2% Market cap: $77.08 B Vol. 24h: $6.57 B adoption in the US.

According to a CoinDesk report, dYdX is rolling out its first-ever spot trading product. dYdX Labs said the move represents an expansion of its roadmap as it pushes deeper into the Solana ecosystem and broadens its user base.

The exchange, which has surpassed $1.5 trillion in cumulative trading volume since its debut, is positioning spot trading as a key new entry point to access the US market opening up amid positive swings in regulatory stance.

To entice new users, especially in the US, dYdX is waiving trading fees for the month of December.

dYdX emphasized that the expansion aligns with its plan to enhance market depth, deploy advanced trading tools while maintaining transparency and self-custody standards that define decentralized finance.

dYdX’s move aligns with major centralized exchange Robinhood which also announced new product launches for US residents in the past week.

Solana Price Forecast: Can Bulls Overcome the $147 Liquidity Wall?

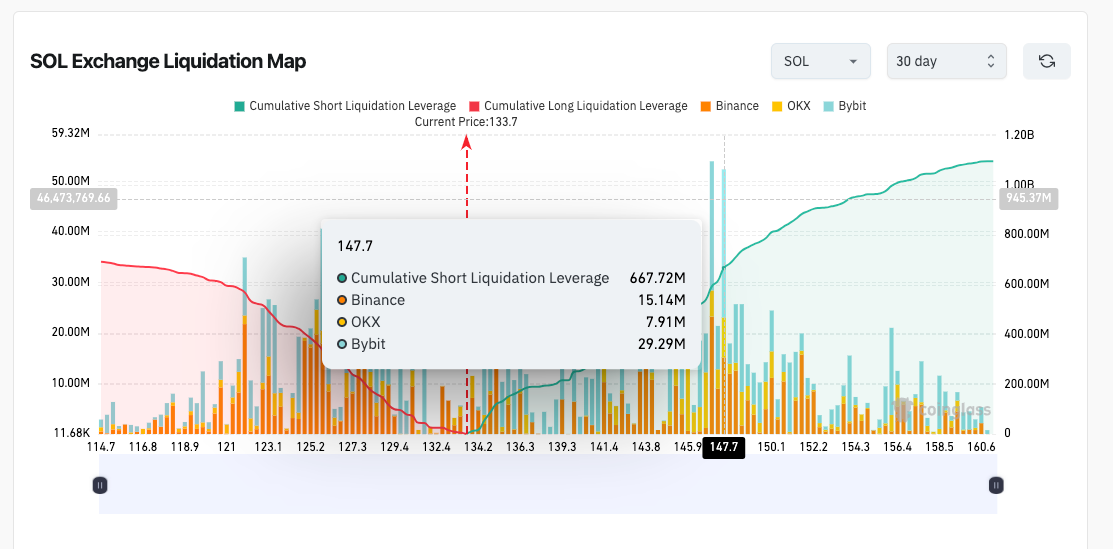

Solana derivatives positioning remains predominantly bearish on Thursday, with traders trimming their bullish exposure market-wide. Coinglass’ liquidation map data, which tracks the sum of active futures contracts at each price level, highlights persistent bearish dominance.

Solana Liquidation Map shows $667 million overhead leverage cluster at $147 | Coinglass, Dec. 11.

SOL long positions have dropped to $692 million at press time, while short positions remain elevated above the $1 billion mark.

A closer look shows that the $147 level is the most significant liquidity pocket Solana traders must watch as the market awaits recovery from the post-Fed-cut sell-off. Traders currently have $667 million positioned at this zone, accounting for nearly 70% of total active leverage. A move above that level could trigger a short-squeeze-driven rally toward $200, as resistance pockets above the threshold appear weaker.

However, with long positions nearly 30% lower than active shorts at press time, Solana’s rebound prospects remain limited.

On the downside, traders are watching $125 as the next support if the market extends its correction this week. Bulls currently hold $337 million in leverage, representing more than 50% of active long positioning at that level. If that support fails, Solana could slide toward the $100 psychological zone, where buyers may attempt to reestablish a stronger defense.

nextThe post dYdX Launches Its First Solana Spot Trading Product in US: Will Solana Price Surge? appeared first on Coinspeaker.

Ayrıca Şunları da Beğenebilirsiniz

Jollibee sets Jan. 24 redemption for $300-M securities

XRP Forms 2022-Like RSI Signal, Next Stop: All-Time Highs?