Aster price holds steady at $0.92 amid volatile market conditions: Bottom taking shape?

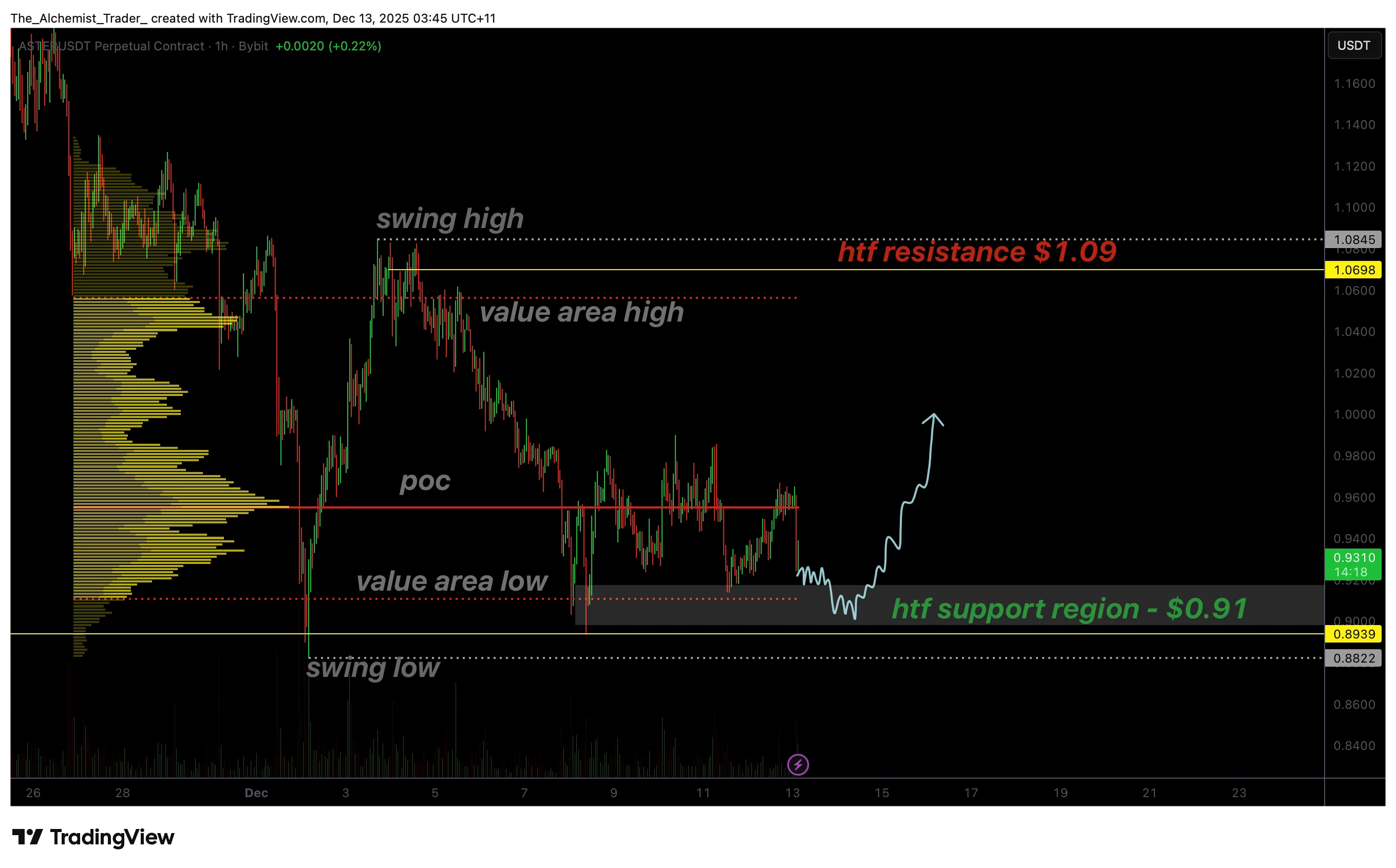

Aster price remains stable around the $0.92 support zone as buyers defend the value area low, raising the possibility of a bottom forming and a potential rotation toward higher resistance levels.

- ASTER maintains stability above the $0.92 support and value area low.

- Repeated buybacks hint at accumulation and early bottom formation.

- A reclaim of the Point of Control could trigger a move toward $0.09 HTF resistance.

Aster (ASTER) continues to demonstrate impressive stability amid broader market volatility, holding firmly around the critical $0.92 support region. Despite external market pressure and fluctuating sentiment, ASTER has retained structure and maintained a key high-time-frame (HTF) support zone.

With price consolidating near the value area low (VAL), analysts are now evaluating whether a bottom is forming and whether ASTER is preparing for a potential rotation toward higher resistance levels.

Aster price key technical points

- Aster trades steadily near the $0.92 support, showing signs of early bottoming behavior.

- Price sits above the Value Area Low and $0.91 HTF support, signalling buyer interest and demand absorption.

- Reclaiming the Point of Control (POC) could trigger a rotation toward the $0.09 HTF resistance.

For several consecutive days, ASTER’s price action has remained anchored around the $0.92 HTF support, forming a stable base despite challenging market conditions. This region aligns with the Value Area Low, representing the lower boundary of fair value in the current trading range.

When price repeatedly holds above the VAL, it often signals that an accumulation phase is underway, with buyers consistently absorbing sell-side liquidity, momentum further supported by Aster revealing its 2026 roadmap, including plans for a new layer-1 blockchain, which has strengthened long-term investor confidence.

The behavior around this support strongly resembles a bullish order-block structure, where repeated recoveries reinforce market confidence. Although ASTER has produced occasional wicks below $0.92, the important detail is that daily candle closes continue to hold above the VAL, confirming that demand persists at this level. These buybacks show that market participants remain willing to accumulate ASTER at current prices, supporting the idea of a bottom forming.

As long as ASTER maintains closes above the value area low, the support remains validated. Temporary dips into the level are acceptable, but strength on closing timeframes confirms that sellers are not gaining control. This pattern reinforces the current region as a foundation for potential upside movement.

The next major structural barrier lies at the Point of Control (POC), the area with the highest traded volume in the current range. A reclaim of the POC often marks the transition from consolidation to expansion, as it indicates reestablished balance and growing bullish participation. If ASTER can successfully reclaim the POC, it would significantly increase the likelihood of a rotation toward the HTF resistance at $0.09.

The $0.09 level is one of the most important resistance zones on ASTER’s chart, acting as both a historical rejection area and a structural upper boundary of the current range. A move toward this level would signal not just recovery but momentum expansion, potentially setting the stage for further trend shifts.

From a market structure perspective, ASTER remains constructive. The asset is defending its HTF support, showing resilience, and consistently absorbing liquidity. These are classic signs of early accumulation, with no indications of a breakdown at present. Still, the reclaim of the POC remains the key signal required to confirm bullish continuation.

What to expect in the coming price action

If ASTER maintains support at $0.92 and reclaims the Point of Control, a rotation toward the $0.09 HTF resistance becomes increasingly likely. Losing support, however, would delay bullish continuation and return ASTER to a broader consolidation range.

Ayrıca Şunları da Beğenebilirsiniz

New Viral Presale on XRPL: DeXRP Surpassed $6.4 Million

Vitalik Buterin Sells 1,400 UNI for 16,796 USDC, Also Moves 10,000 KNC and 400 Trillion DINU