Half-Billion Dollar Bet: Bitcoin OG Scales Multi-Asset Long To $611 Million

Bitcoin enters the week trapped in a tight consolidation range, reflecting a market caught between caution and expectation. Price action has stalled as traders wait for clearer direction after the recent Federal Reserve decision and ongoing macro uncertainty.

Yet beneath the surface, whale activity tells a very different story. According to Lookonchain, one of the most notable market participants—the famous BitcoinOG, known for accurately shorting the market during the sharp October 10 crash—is now aggressively expanding his long exposure across multiple assets.

His current positioning is substantial: 150,466 ETH valued at approximately $491 million, 1,000 BTC worth $92.6 million, and 212,907 SOL totaling $27.8 million. Rather than scaling out or reducing risk during this period of market hesitation, he continues to build, signaling strong conviction in a broader recovery across major cryptocurrencies.

While retail traders and smaller speculators wait for confirmation, this whale is positioning early, anticipating a potential shift in momentum. His actions add a new layer of intrigue to Bitcoin’s consolidation, raising the question of whether smart money is preparing for a trend reversal while the rest of the market hesitates.

Whale Positioning and Strategic Bids Ahead

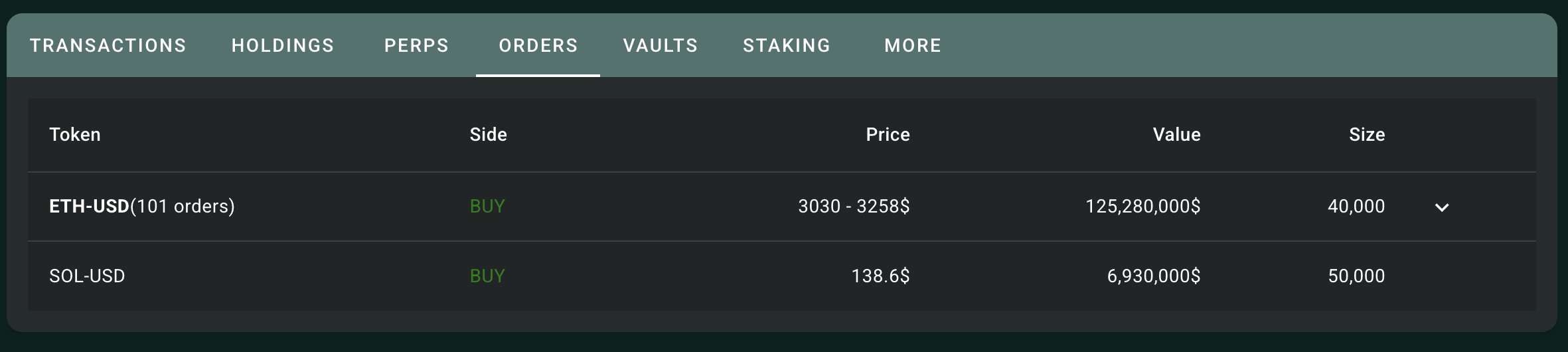

Lookonchain reports, citing Hypurrscan data, that this whale isn’t just holding an already massive multi-asset long position—he is strategically preparing to increase exposure even further. According to the data, he has placed limit orders to add an additional 40,000 ETH in the $3,030–$3,258 price range and 50,000 SOL at $138.6. These levels are positioned just below current market prices, suggesting he expects—or is at least prepared for—a deeper pullback before the next major move.

This behavior is notable because it reflects a deliberate accumulation strategy rather than impulsive buying. By setting large bids at key support zones, he aims to capture liquidity during periods of volatility, effectively using market weakness to scale into long-term positions. Such an approach is typical of sophisticated traders who rely on structured entries rather than reacting to short-term fluctuations.

The scale of these pending orders also indicates that his conviction extends beyond his already massive exposure. If filled, these additions would significantly increase his leverage in the broader crypto market, particularly in Ethereum and Solana. For observers, this raises an important question: is this smart money positioning ahead of a potential macro-driven rebound, or is it a high-risk bet into an uncertain environment?

Bitcoin Price Analysis: Testing Support, Lacking Momentum

Bitcoin’s latest price action on the 3-day timeframe shows a market stuck between recovery attempts and lingering downside pressure. After the sharp November sell-off, BTC stabilized above the $90,000 zone, which is now acting as a short-term support area. Price briefly dipped below this level but was quickly bought back, suggesting that buyers are still defending the region. However, the rebound remains shallow, and the structure lacks the strong momentum typically seen during bullish reversals.

The chart shows BTC trading below the 50-day and 100-day moving averages, both of which have now turned downward. This alignment reflects a shift toward medium-term bearish conditions. The 200-day moving average currently sits below the price and has become the most important dynamic support; BTC is hovering directly above it. Historically, when Bitcoin holds the 200-day MA after a major correction, a consolidation phase often follows before a decisive move.

Volume also reinforces the uncertainty. Despite multiple attempts to push higher, buying volume remains muted compared to previous rallies, indicating limited conviction from bulls. Until BTC breaks convincingly above the 50-day MA region near $100K, the market will likely remain in a cautious, range-bound state.

Featured image from ChatGPT, chart from TradingView.com

Ayrıca Şunları da Beğenebilirsiniz

Waarom BTC niet stijgt: OG holders verkopen massaal call opties

OFAC Designates Two Iranian Finance Facilitators For Crypto Shadow Banking