Here’s The Demographic That Continues To Dominate XRP

As volatility weighs heavily on the market, fresh insights are shedding light on who is really driving activity in the XRP ecosystem. A crypto analyst has shared new observations, revealing that a specific demographic continues to dominate XRP trading activity. The analyst explained that this trend has held steady despite the cryptocurrency experiencing notable downside momentum, with prices sliding to new lows amid broader market uncertainty.

Analyst Says Whales Are Dominating XRP

A recent analysis report by market expert Xaif Crypto suggests that whales remain the dominant demographic influencing price action. He shared a chart on X highlighting Spot Average Order Size on the XRP Ledger, showing normal, retail, and big and small whale orders.

The analyst noted that the recent spike in XRP trading has been driven primarily by whales. According to his report, this trend has persisted despite the altcoin entering a period of short-term price weakness. The cryptocurrency has recently declined toward its lowest price levels this year, raising concerns among smaller investors.

Xaif Crypto explained that this type of behavior from whales is often seen during market bottoming phases. He emphasized that large holders typically increase accumulation when prices are depressed and avoid aggressive buying once a strong uptrend is already underway. The analyst also noted that this strategy suggests whales may be positioning themselves ahead of a potential recovery in XRP’s price.

The continued presence of whales has also helped stabilize liquidity to some degree during the ongoing decline. While retail traders may hesitate amid falling prices, whale activity tends to prevent sharp breakdowns by absorbing significant selling pressure.

Buying Sentiment Surges Amid Price Weakness

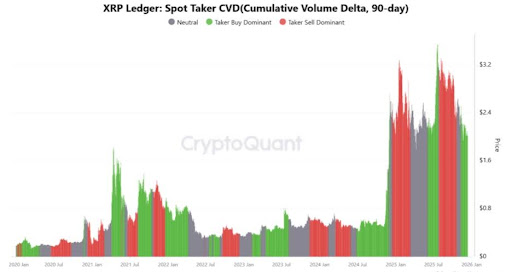

A CryptoQuant analyst who also highlighted that XRP’s trading activity continues to be dominated by whales has observed a notable change in the cryptocurrency’s Spot Taker CVD. According to the analyst’s report, XRP’s Spot Taker CVD has entered a taker-buy dominant trend. This shift suggests that aggressive buyers are now outweighing sellers, often interpreted as a sign of strengthening market sentiment and potential upside for price action.

These market changes follow XRP’s sharp drop, which has pushed its price below $2 for the first time in months. The cryptocurrency has struggled to break through resistance zones needed to establish new highs, keeping overall sentiment cautious among traders.

At present, XRP is trading around $1.82, down more than 6% over the past 24 hours, according to CoinMarketCap. Over the past week, the cryptocurrency’s price has fallen by nearly 9%, adding to the broader bearish outlook. XRP’s year-to-date performance is also negative, with the cryptocurrency losing about 22% of its value so far.

Despite these severe declines, buying activity has increased significantly. Additionally, daily trading volume has surged by more than 97%, suggesting renewed interest as whales continue to shape the market’s direction.

Ayrıca Şunları da Beğenebilirsiniz

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

ServicePower Closes Transformative Year with AI-Driven Growth and Market Expansion