Ondo Finance to Launch Tokenized US Stocks and ETFs on Solana in Early 2026

Real-world asset tokenization pioneer expands beyond fixed income with 24/7 custody-backed equity trading

Ondo Finance plans to launch tokenized U.S. stocks and exchange-traded funds on the Solana blockchain in early 2026, marking a significant expansion of the company's real-world asset (RWA) tokenization platform beyond its current focus on Treasury bonds and money market funds into equity markets with custody-backed structures enabling round-the-clock on-chain transfers and trading.

Breaking Traditional Market Barriers

The initiative represents one of the most ambitious attempts to bridge traditional equity markets with blockchain infrastructure, potentially transforming how investors access and trade U.S. securities by eliminating the temporal constraints of conventional market hours.

Traditional U.S. stock markets operate approximately 6.5 hours daily during weekdays (9:30 AM to 4:00 PM Eastern Time), with pre-market and after-hours sessions offering limited liquidity and wider spreads, while Ondo's tokenized securities would enable continuous 24/7 trading and near-instantaneous settlement through blockchain rails.

The custody-backed structure distinguishes Ondo's approach from synthetic derivatives or contract-for-difference products, with actual underlying securities held in qualified custody ensuring each tokenized share represents genuine ownership of real stocks or ETF units rather than derivative exposure.

Solana blockchain selection leverages the network's high throughput (capable of processing thousands of transactions per second) and low transaction costs (typically fractions of a cent per transaction) making frequent trading and small-value transfers economically viable unlike Ethereum's historically higher gas fees.

Ondo Finance's RWA Track Record

Understanding Ondo's equity tokenization ambitions requires context from the company's established position in tokenized fixed income products demonstrating regulatory navigation capabilities and institutional partnerships.

USDY (U.S. Dollar Yield) represents Ondo's flagship product providing tokenized exposure to short-term U.S. Treasuries and bank demand deposits, accumulating over $500 million in assets under management since launch.

OUSG (Ondo Short-Term U.S. Government Treasuries) offers institutional investors tokenized access to short-duration government bonds with blockchain-based transfer and settlement capabilities.

The company has successfully navigated securities registration requirements, established relationships with traditional financial institutions providing custody and administration, and built compliance infrastructure necessary for regulated tokenized products.

Solana deployment experience through existing USDY availability on Solana alongside Ethereum provides technical foundation and network relationships supporting equity product expansion.

This operational history suggests Ondo possesses regulatory sophistication and institutional partnerships necessary for more complex equity tokenization compared to crypto-native startups lacking traditional finance integration.

Regulatory Framework Challenges

The early 2026 timeline acknowledges the substantial regulatory approval process required for tokenized equity securities in the United States under existing securities laws.

Securities registration with the SEC represents the primary regulatory hurdle, as tokenized stocks and ETFs clearly constitute securities requiring either registration statements or exemption qualifications before public offering.

Transfer agent regulations govern how securities ownership records are maintained, requiring Ondo or partners to register as transfer agents or utilize registered entities for tracking tokenized share ownership.

Broker-dealer requirements may apply depending on how tokenized securities are distributed and traded, potentially requiring Ondo to register as broker-dealer or partner with registered firms.

Custody regulations under SEC custody rules and banking laws require qualified custodians holding underlying securities meeting strict operational, financial, and insurance requirements.

AML/KYC compliance demands robust know-your-customer procedures and anti-money laundering monitoring despite blockchain's pseudonymous characteristics, creating tension between crypto permissionlessness and securities compliance.

Accredited investor limitations might restrict initial offerings to qualified purchasers or accredited investors under Regulation D exemptions before broader retail availability.

The 12+ month timeline until early 2026 suggests Ondo recognizes regulatory approval represents extended process requiring SEC engagement, legal structuring, and potentially novel regulatory interpretations.

Technical Architecture and Mechanics

Implementing custody-backed tokenized equities with 24/7 trading requires sophisticated technical infrastructure addressing pricing, settlement, and corporate action challenges.

Custody structure likely involves qualified custodian (potentially major banks or specialized firms like BNY Mellon or State Street) holding actual stock certificates or book-entry positions with tokenized representations on Solana blockchain.

Token minting and redemption mechanisms enable authorized participants or Ondo itself to create new tokens when purchasing underlying securities and burn tokens when redeeming for underlying stocks, maintaining 1:1 backing ratio.

Pricing during market hours can reference real-time stock prices from exchanges during traditional trading sessions enabling market-driven price discovery for tokenized versions.

Off-hours pricing challenges emerge when underlying markets close but tokenized versions trade continuously—likely relying on last closing price or fair value estimates until markets reopen creating potential arbitrage opportunities.

Settlement finality occurs on-chain within seconds or minutes compared to T+1 settlement for traditional equity trades, though ultimate underlying custody transfers still face traditional settlement timing.

Corporate action handling including dividends, stock splits, mergers, and rights offerings requires automated smart contract logic or manual intervention distributing benefits to tokenized shareholders proportionally.

Voting rights present complex challenges as blockchain addresses may not satisfy shareholder-of-record requirements for proxy voting, potentially requiring additional verification or delegation mechanisms.

Market Structure Implications

Tokenized equities operating parallel to traditional markets create novel market structure dynamics around liquidity, price discovery, and arbitrage.

Liquidity fragmentation splits order flow between traditional exchanges (NYSE, Nasdaq) and tokenized on-chain markets potentially reducing depth and increasing spreads in both venues.

Price discovery mechanisms require efficient arbitrage between traditional and tokenized versions maintaining price parity despite different market structures and participant bases.

Arbitrage opportunities emerge from pricing discrepancies between venues, off-hours trading creating gaps with traditional market opens, and different liquidity conditions across platforms.

Market makers providing liquidity for tokenized securities face unique challenges maintaining inventory across traditional and blockchain venues while managing custody and settlement logistics.

Authorized participants similar to ETF structure might facilitate arbitrage and liquidity provision through privileged ability to mint and redeem tokens against underlying securities.

The success depends heavily on whether sufficient liquidity develops in tokenized markets to create viable alternative to traditional trading or whether products remain niche offerings for specific use cases.

Target User Base and Use Cases

Identifying primary customer segments and value propositions reveals commercialization strategy and realistic market potential.

International investors facing time zone challenges accessing U.S. markets during local business hours benefit from 24/7 availability eliminating need to trade at inconvenient times.

Cryptocurrency-native investors holding digital assets on exchanges or wallets gain easier access to traditional equity exposure without off-ramping to fiat banking systems and traditional brokerages.

DeFi integration enables tokenized stocks as collateral in lending protocols, liquidity provision in automated market makers, and composability with other DeFi primitives creating novel financial products.

Fractional ownership becomes economically viable as low transaction costs enable purchasing dollar amounts rather than whole shares particularly for high-priced stocks like Berkshire Hathaway Class A or Amazon.

Programmatic trading and algorithmic strategies benefit from API-based blockchain access and 24/7 markets enabling continuous automated execution.

Corporate treasuries and institutional investors might utilize tokenized securities for settlement efficiency, reduced counterparty risk, and operational cost savings.

However, mainstream retail investors satisfied with traditional brokerages offering zero-commission trading and familiar interfaces may lack compelling reason to adopt tokenized alternatives.

Competitive Landscape

Ondo enters increasingly crowded tokenized securities space with established players and recent entrants pursuing similar real-world asset tokenization strategies.

Backed Finance offers tokenized stocks on blockchain including major tech companies and indices, operating from Switzerland leveraging favorable regulatory environment.

DeFi protocols including Synthetix offer synthetic equity exposure through derivatives rather than custody-backed tokens, providing different risk-reward and regulatory profiles.

Traditional finance initiatives from BlackRock (BUIDL fund), Franklin Templeton (BENJI), and other asset managers focus on money market funds and fixed income rather than equities currently.

Securitize provides technology infrastructure for tokenizing securities and has partnered with KKR and other firms for private market tokenization potentially expanding to public equities.

INX Limited operates SEC-registered security token trading platform offering tokenized securities though with limited product range and trading volumes.

Ondo's advantages include established RWA platform, Solana technical infrastructure, institutional relationships from fixed income products, and regulatory navigation experience, while competition comes from both crypto-native and traditional finance incumbents.

Revenue Model and Economics

Understanding Ondo's business case requires examining fee structures and unit economics for tokenized equity products.

Management fees similar to ETF expense ratios (typically 0.10%-0.50% annually) provide recurring revenue on assets under management scaling with product adoption.

Transaction fees on minting and redemption could generate revenue though competitive pressure and desire for adoption might minimize these charges.

Spread capture between bid-ask on tokenized securities if Ondo provides market-making services creates trading revenue.

Custody fees charged by underlying custodians reduce net margins requiring sufficient scale to absorb fixed costs while maintaining competitive pricing.

Technology licensing to other institutions seeking similar tokenization capabilities could provide additional revenue stream beyond proprietary products.

The economics depend heavily on achieving meaningful scale as fixed regulatory, technology, and custody costs require substantial AUM to reach profitability.

Risk Factors and Challenges

Multiple operational, regulatory, and market risks could prevent successful launch or limit adoption post-launch.

Regulatory rejection or delays represent primary risk as SEC might deny approval, request modifications delaying launch, or approve with restrictions limiting product viability.

Custody and counterparty risk exists if custodian faces financial distress, operational failures, or fraud despite qualification requirements and insurance coverage.

Smart contract vulnerabilities could enable theft or loss of tokenized securities through code exploits despite auditing and security best practices.

Market acceptance remains uncertain as investors might prefer familiar traditional brokerages over novel blockchain-based alternatives particularly given learning curves.

Liquidity challenges could result in wide spreads and poor execution quality if insufficient market participants provide liquidity for tokenized securities.

Oracle and pricing risks during off-hours when underlying markets close create potential for manipulation or price disconnects from fair value.

Corporate action complexity including special situations like tender offers, bankruptcy proceedings, or complex mergers might prove difficult to handle through automated smart contract logic.

Regulatory changes could impose new restrictions on tokenized securities, stablecoin usage for settlement, or blockchain-based financial products after launch.

Comparison to Traditional Brokerages

Evaluating tokenized equities requires comparing value proposition against established zero-commission brokerages and mainstream investment platforms.

Trading costs through traditional brokerages now typically zero for stock trades while tokenized versions might include transaction fees despite low blockchain costs.

User experience for traditional platforms benefits from decades of refinement, regulatory protection (SIPC insurance), and familiar interfaces versus crypto wallet complexity.

Product range at major brokerages includes thousands of stocks, options, bonds, mutual funds, and research while initial tokenized offerings likely cover limited universe.

Customer service and dispute resolution through traditional firms provide recourse unavailable in decentralized or crypto-native systems.

Tax reporting integrates seamlessly with existing 1099 and cost-basis systems for traditional accounts while tokenized securities create complexity.

Margin and lending against portfolios well-established in traditional finance but limited in crypto contexts or requiring collateral haircuts.

The comparison suggests tokenized equities must offer compelling advantages beyond novelty to justify switching costs and learning curves for mainstream investors.

Institutional Adoption Potential

Success likely depends on institutional rather than retail adoption given compliance requirements and use case alignment.

Hedge funds and proprietary trading firms might utilize 24/7 markets for continuous risk management and algorithmic strategies.

International asset managers could access U.S. equities during local business hours improving operational efficiency.

Cryptocurrency funds and treasuries managing digital assets gain easier method for diversifying into traditional equities without complex fiat conversion.

Family offices and high-net-worth individuals might appreciate programmability and DeFi integration for sophisticated wealth management strategies.

Pension funds and insurance companies face regulatory and operational barriers likely preventing near-term adoption despite potential settlement efficiency benefits.

Retail brokerages might eventually integrate tokenized securities offering clients choice between traditional and blockchain-based access to same underlying equities.

The institutional focus aligns with accredited investor limitations likely constraining initial offerings and realistic customer acquisition given regulatory environment.

Global Regulatory Considerations

While focusing on U.S. securities, Ondo must navigate international regulations as blockchain enables global access to tokenized assets.

Cross-border securities regulations restrict offering U.S. securities to foreign investors without compliance with local laws creating jurisdictional complexity.

Geofencing and access controls might limit who can access tokenized securities based on IP address or verified location though blockchain pseudonymity complicates enforcement.

International custody and settlement for non-U.S. investors creates operational challenges around currency conversion, tax withholding, and regulatory reporting.

MiCA regulations in European Union impose requirements on crypto asset service providers potentially affecting European access to Solana-based tokenized securities.

Different tokenization approaches in jurisdictions like Switzerland, Singapore, and UAE might create fragmented markets with limited cross-border interoperability.

Technology Stack and Infrastructure

Delivering institutional-grade tokenized securities requires robust technology infrastructure addressing security, scalability, and compliance.

Solana blockchain provides base layer for token issuance, transfers, and settlement leveraging proof-of-stake consensus and high throughput.

Smart contracts govern token minting, redemption, corporate actions, and compliance rules through automated on-chain logic.

Oracle integration provides real-time and historical price data for underlying securities supporting fair valuation and liquidation.

Custody integration APIs connect blockchain infrastructure with traditional custodians holding underlying securities enabling coordinated minting and redemption.

KYC/AML systems verify investor identities and screen transactions against sanctions lists despite blockchain pseudonymity through off-chain compliance layers.

Wallet infrastructure including institutional-grade custody solutions from Fireblocks, Anchorage, or BitGo secure tokenized securities with appropriate controls.

Analytics and reporting provide investors with performance tracking, tax documentation, and portfolio management tools comparable to traditional platforms.

Ayrıca Şunları da Beğenebilirsiniz

Dogecoin (DOGE) and Shiba Inu (SHIB) Likely to Underperform as Capital Flows to New Token Set to Explode 19365%

Metaplanet raises $1.4B to fuel BTC purchases and U.S. subsidiary launch

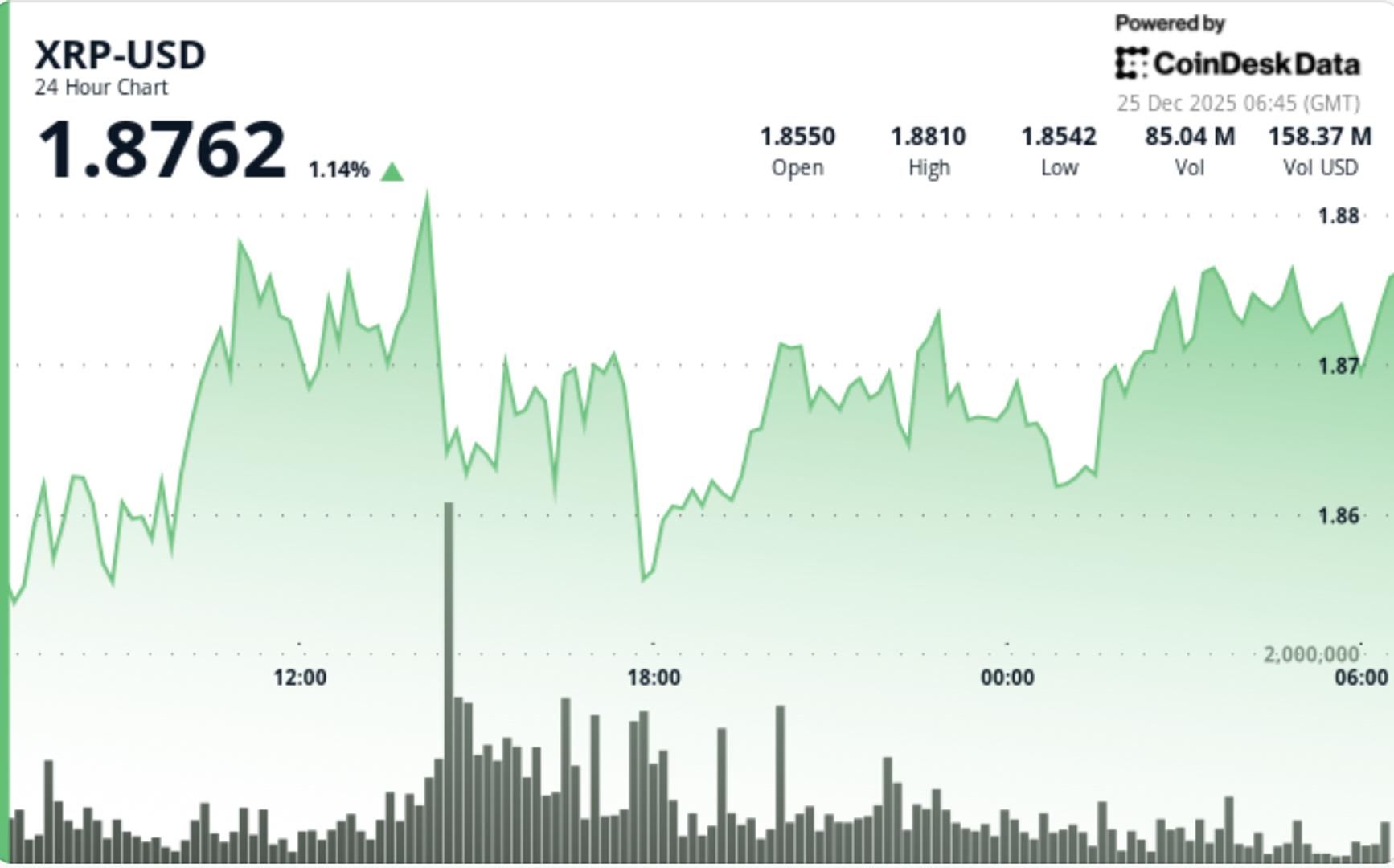

XRP ETF net assets cross $1.25 billion milestone, but price-action muted

Copy linkX (Twitter)LinkedInFacebookEmail