Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

15882 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

USDDD Listed on CoinMarketCap as DIGDUG.DO Signals Acceleration Toward Ecosystem Expansion

2026/02/17 15:37

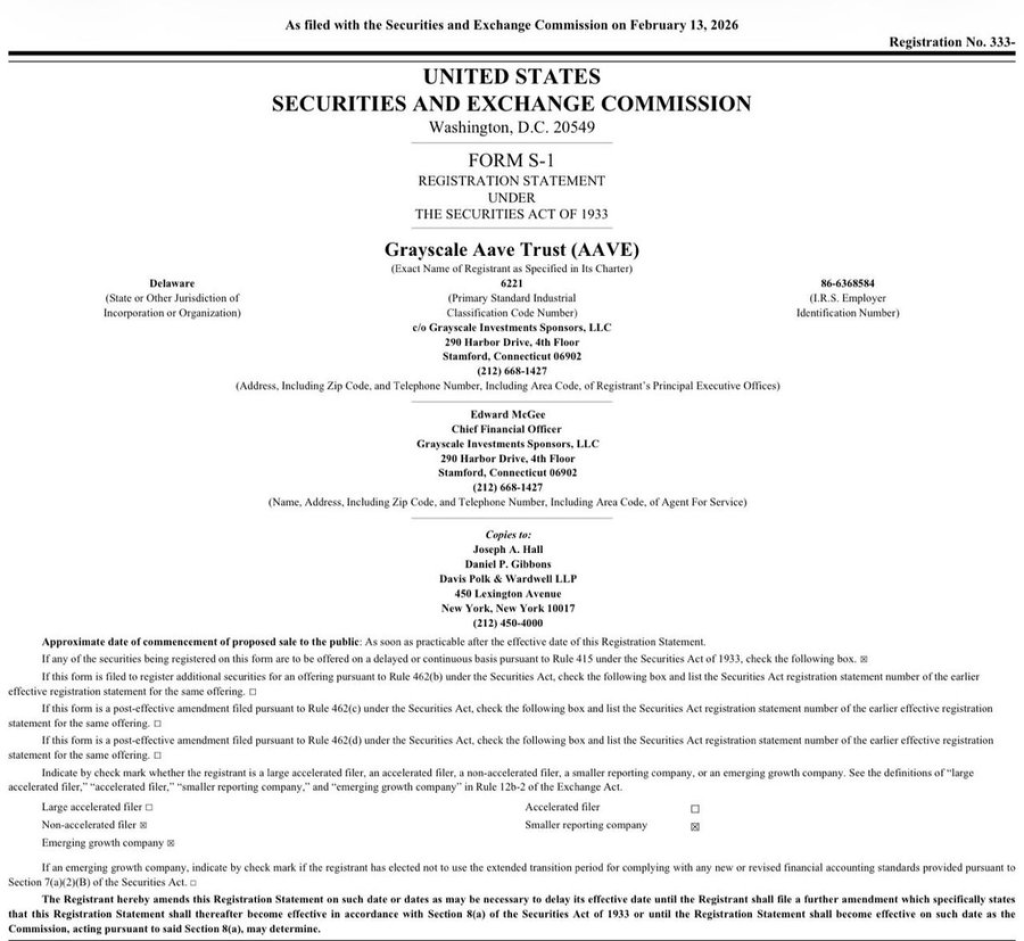

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

2026/02/17 15:30

The Evolution of his Technique: How David Segal Adapts the Drumstick Grip and Setup

2026/02/17 15:21

Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More

2026/02/17 15:20

Will HBAR’s Remarkable Technology Propel It To $0.5?

2026/02/17 14:47