Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

14526 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Next 1000x Meme Coin Signal: APEMARS Stage 7 Tops Best Crypto to Buy Today With 9763% Upside While SHIB, FARTCOIN Lag

2026/02/08 08:15

Top Altcoin Picks: Origin Expands Ecosystem, and Maker Strengthens DeFi While APEMARS Lead as Next Crypto To Hit $1 With 9,700% ROI

2026/02/08 08:15

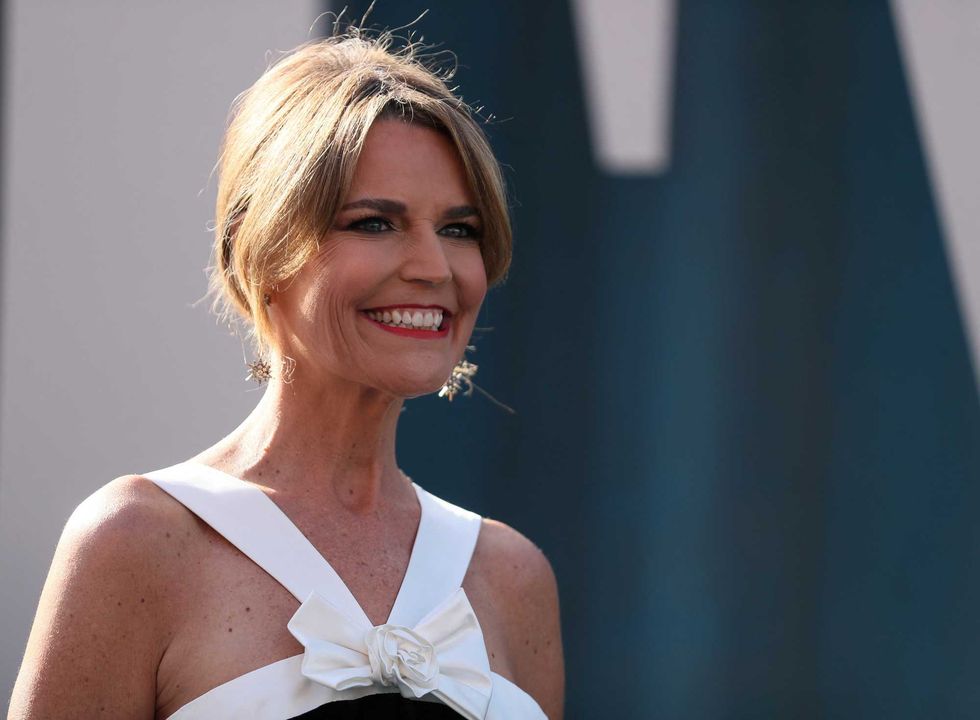

Savannah Guthrie communicates with mom's kidnappers in new vid: 'We received your message'

2026/02/08 08:13

Trading volume for BTC and ETH surged unusually in the early hours of the morning, causing sharp price fluctuations in a short period.

2026/02/08 08:02

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

2026/02/08 07:30