Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

16243 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

This maniac's obsession is poison to MAGA

2026/02/19 18:30

US CLARITY Act Could Clear Congress by April, Says Senator Moreno

2026/02/19 18:20

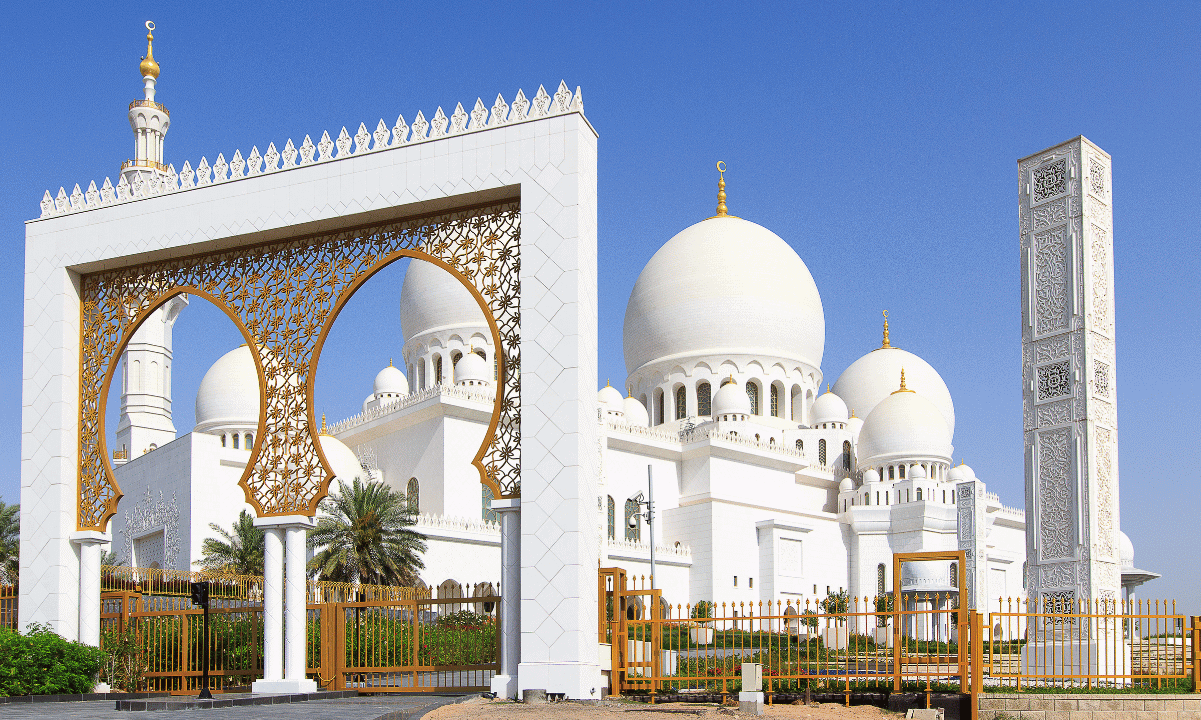

Why The UAE Now Treats Bitcoin Like Gold With Over $1 Billion In BTC?

2026/02/19 18:07

WLFI will tokenize loan revenue from the Trump family's Maldives resort.

2026/02/19 18:06

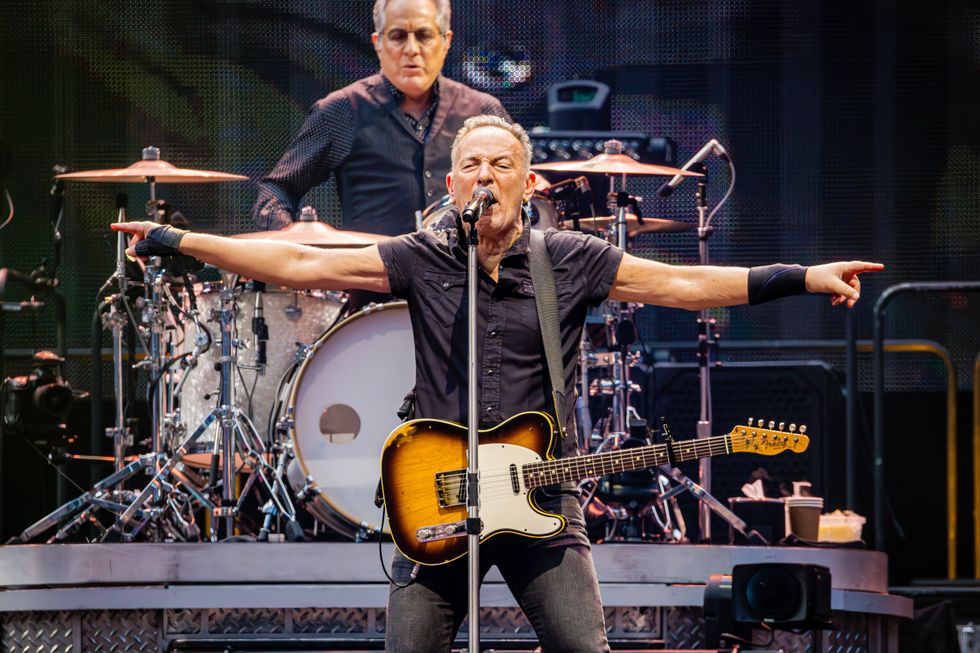

‘Which Side Are You On?’ American protest songs have emboldened social movements for generations

2026/02/19 17:49

![[Vantage Point] SEC’s proposed EIR cut: Consumer protection or credit contraction?](https://www.rappler.com/tachyon/2025/12/vantage-point-SEC-float-gambit.jpg?resize=75%2C75&crop=289px%2C0px%2C720px%2C720px)